The end of the year is upon us soon. This is the time when bloggers turn pensive and begin to pen their reflections. In order not to clog up my upcoming year-end review post, I will be detailing my crypto transactions for the quarter first.

In this quarter, I initiated a position in Synthetix Network Token.

For those who follow blogger Got Money Got Honey on his blog and twitter account, Synthetix Network Token would no doubt be a familiar name to you.

Look at the above screenshot. The number of times I muttered "simi sai" (what is this shit) under my breath when I view his twitter posts is uncountable. Where got 122% dividend yield per annum one? How come got free lunch in investing? Where is this supposed free lunch coming from?

It was not easy trying to wrap my head around the Synthetix Network Token. I had to read their whitepaper multiple times before I could get a basic understanding of how it works. Even then, I still think my understanding of it is at a superficial level. Well, at least I understand the risks inherent in the system now.

How do you get the juicy yields? First, you need to stake/lock-up Synthetix Network Tokens (SNX) in the mintr application to qualify for the rewards. However, in doing so, you create "debt" (awkward phrasing by their team, I know). The more SNX locked-up and debt you create, the more rewards you qualify for. Yes, you cannot lock SNX but choose not to create debt; it's not an either-or thing.

What is debt? Synthetic assets serve as the debt in their system. For example, people new to the system normally mint synthetic USD (sUSD), which is a proxy for the US Dollar, by locking up their SNX. Other synthetic assets include synthetic Bitcoin (sBTC) and synthetic Ether (sETH). Their exchange also accommodates fiat currencies and commodities. For example, synthetic Japanese Yen (sJPY), synthetic Australian Dollar (sAUD), synthetic Gold (sXAU), synthetic Silver (sXAG), etc.

There is a limit to how much debt/synthetic assets you can create. Currently, the collateralization ratio is set at 750% (e.g. for every $750 worth of SNX collateral, you can mint $100 worth of debt/synthetic assets). If the ratio is not maintained above 750% because the price of SNX falls, your rewards are forfeited until you top-up your wallet with enough SNX to bring that ratio above 750%.

Still with me? I did my best to simplify things, lol.

Let's introduce two characters to understand how the rewards work.

Xiao Ming buys $750 worth of SNX and uses it to mint $100 worth of sUSD.

Da Ming buys $750 worth of SNX and uses it to mint $100 worth of sBTC.

Assuming that there are only two participants in the system, the total "debt"/AUM of the system is now $200, with Xiao Ming contributing $100 or 50% of the AUM and Da Ming contributing $100 or the other 50% of the AUM.

Let's say Bitcoin doubles in price while USD remains flat. Following this change, the total "debt"/AUM of the system grows to $300.

To withdraw your SNX collateral from the system, you are required to pay back the debt/synthetic assets in proportion to your initial contribution to the pool. As stated above, each individual contributed to 50% of the AUM at the start. With the increase in the overall debt/synthetic asset pool to $300, each individual has to pay $150 worth of synthetic assets before they are able to withdraw their SNX from the system. Hence, Da Ming's profits come at the expense of Xiao Ming.

That's Synthetix in a nutshell. I have left out plenty of details as it is a complicated system with high risks and high rewards and I do not want to reveal how I am going to position myself such that I am closer to the hypothetical Da Ming's position than Xiao Ming's position.

In terms of risk management, I have capped my exposure to Synthetix Network Token to a lower-middle size position. I have also overcollateralized above and beyond the 750% collateralization ratio.

The interesting thing is that SNX is standing strong in this current crypto bear market. Maybe the ~1.xx % dividend yield per week/fortnight serves as a price floor? If the price increases a teeny weeny bit more and stays there, SNX will be the second double bagger in my portfolio (not including the accumulated ~10% dividend yield I have received over the past 2 months). =D =D =D

In this quarter, I initiated a position in RealT tokens.

RealT is an ethereum-based company that offers tokenized US Real Estate to investors. Each property is owned by a LLC, with token holders of that particular property owning that LLC. Rent is paid daily in the DAI stable coin (1 DAI = 1 USD) to token holders.

The properties are based in Detroit, so some caution is warranted. As a result, I have sized my position to the absolute minimum.

In this quarter, I bought a couple of Gods Unchained booster packs.

Gods Unchained is an online trading card game. However, its underlying assets (the cards) are traded on the ethereum blockchain as tokens. There are multiple benefits to tokenizing game assets on the blockchain. First, it creates transparency as to the supply of a given game asset; gamers could verify for themselves whether the game developers have inflated certain assets. Second, the assets remain your property even if the game company cease to exist. Third, the sprouting of new game companies that use existing assets belonging to you may earn royalty income or confer in-game advantages in new games.

Consider the following hypothetical scenario where you are the owner of the "Iron Man" token.

You have bought the rights to it in a Marvel game. Somewhere along the line, there is a collaboration between Marvel and Capcom, producing the game Marvel vs Capcom. Oh look! Your Iron Man token got used by them.

Oh? What's this? Lego is collaborating with Marvel for a Lego Marvel game? Hey, that's Iron Man again!

The results for my Gods Unchained "investment" so far are mixed. Some of my cards fetched more value than the booster packs that I bought them for while others turned out to be flops. Compared to my "investment" into Axie Infinity, Gods Unchained is definitely a much better option as it has an active and thriving community.

In this quarter, I bought an Ethereum Name Service (ENS) domain name.

The rationale is to flip them for capital gains. ;)

In this quarter, I added to my positions in Bitcoin, Ether, and DAI.

I have closed my DAI lending positions on Compound Finance and dYdX exchange as lending rates have cratered from 6 - 12% yield per annum to 1.5 - 2% yield per annum due to the inflow of liquidity into these decentralized lending/borrowing protocols.

I have shuffled my DAI into MakerDAO's DAI Savings Rate for a fixed 4% yield per annum.

Thanks for reading!

Friday, December 20, 2019

Friday, October 25, 2019

Q3 2019 Portfolio Update

Time flies and another quarter is over. I haven't really been paying attention to the traditional financial markets. Instead, I have been spending more time reading up on the improving fundamentals of the cryptocurrency market and its associated risks.

Dividend Income

For my SGD-denominated portfolio, Q3 2019 dividend income registered a slight fall compared to the same quarter of the preceding year. This is to be expected following my partial divestment of Singtel in Q2 2019 (see here). I foresee that changes to my forward SGD-denominated dividend income to be minimal. The REITs and income stocks that I am eyeing are on the high side and I am not willing to add to them.

For my USD-denominated portfolio, dividends received hit a new high again when compared to the same quarter of the preceding year. This is mainly due to capital injections over the past 1 year and some dividend growth during this period.

Transactions

In this quarter, I added to my position in HongKong Land at a PB of 0.34 following the huge drop in price due to the Hong Kong protests. Looking back at my old posts, the last time I added to HongKong Land was in Q4 2018 at a PB of 0.37. Regular readers will know that HongKong Land is one of the pillar stocks in my equities allocation. Still, I'll be looking to add to my position after doing some crude form of risk management (e.g. add to other positions to dilute the significance of HongKong Land in determining my portfolio returns).

I added to gold (jewellery) as a gift to my mum and silver (fortunately before the run-up in precious metal prices).

I closed my position in QAF at a 42% loss (after including dividends) over a period of 2 years and 4 months. A combination of "I don't think I want to wait for their primary production business unit to turn around", "QAF is just a small position in my portfolio (0.69% of equities allocation, based on Q2 2019 post)", and "alternatives with better risk-reward profiles are currently available on the market" contributed to my divestment of QAF.

I guess it is very obvious by now what "alternatives with better risk-reward profiles" refer to.

Hence, in this quarter, I added to Bitcoin, Ether, DAI, and USD Coin (USDC).

Salient points regarding the Ethereum Blockchain

Blogger friends and readers have asked for my take on cryptocurrencies ever since I first mentioned it in my last quarter's update. Now, this is no easy thing to write. Should the post be comprehensive or lighthearted (I have a lighthearted post on Ethereum here)? Should I trace out the history or just share what's new in cryptocurrencies? As I eventually will have to tackle this topic, I think it is high time to do it here, albeit in an abbreviated form with plenty of missing pieces for readers to investigate on their own if they are curious enough.

The Ethereum blockchain has been improving by leaps and bounds, even as the price for Ether trends in the opposite direction. One particular use case that has emerged is Decentralized Finance (DeFi). With this development, ethers and other ethereum-based coins are not held solely for capital gains or losses anymore; coins could be used to participate in a nascent alternative financial system.

For lenders, yields on DeFi platforms are fairly generous. To put this in proper perspective, the risk premium above the risk-free rate is telling enough. These platforms are new, untested, and have yet to suffer a catastrophic failure. For borrowers, DeFi advocates would generally tout the less onerous interest rates compared to traditional borrowing tools like credit cards. I do not engage in any borrowing through DeFi, so my sharing in this area is limited.

I am also quite surprised that the majority of people are not aware of stable coins. Stable coins are cryptocurrencies whose prices do not fluctuate. Critics of cryptocurrencies are often quick to point out that the volatility of cryptocurrencies make for very bad currencies. This is where stable coins come in. It facilitates the transaction of goods and services at a fixed price. Two of the more commonly used stable coins in the DeFi environment are DAI and USDC.

USDC is created by CENTRE, a joint project between Coinbase, a centralized exchange, and Circle. 1 USDC is both backed and pegged to 1 US Dollar (USD). USDC could be purchased at exchanges like Coinbase. Monthly audit reports on the US dollar reserves backing the USDC could be found here on CENTRE's website. The risks associated with using USDC are mainly counterparty risks (if you do not trust Centre, their regulators, audit numbers) and regulatory risk (e.g. authorities adopting a stricter stance against it).

DAI is a decentralized stable coin backed by Ethers. DAI could be obtained through one of two ways: (1) pledging ethers as collaterals to mint DAI, or (2) purchasing DAI minted by others that are sold on the secondary markets. Through a complicated process, 1 DAI is maintained at 1 US Dollar (USD). Hence, DAI is backed by Ethers and pegged to USD. However, there have been occasions where the peg to USD broke. This is one risk that DAI holders should be aware of.

Two of the DeFi protocols which I have been using to earn interest on my stable coins are Compound Finance and dYdX.

Compound Finance functions as a money market fund within the cryptocurrency universe. Cryptocurrencies deposited (both volatile coins as well as stable coin) are lended out to borrowers who borrow through the same platform. Lenders lend to an aggregated pool of a particular asset (e.g. USDC) and it is from this pool that borrowers borrow from. The interest earned from borrowers are spreaded across all lenders regardless of whether their portion of the asset pool have been borrowed. Borrowing from the platform requires overcollateralization. This protects lenders as the borrower's collateral could be liquidated to repay lenders once it falls below a certain threshold.

I have a token sum in the dYdX protocol for diversification (not all eggs in one basket!) and risk management. Other than that, my knowledge of the protocol is superficial.

The dangers of using decentralized services include bugs, hacks, administrative privilege risk, price oracle risk, and liquidity risk.

Besides using decentralized services, I use centralized services as well. Specifically, I am on Crypto.com's Earn program, earning interest from lending out my Ethers.

The main risks associated with using centralized services are hacks, the fear of founders running off with the deposited assets, lack of transparency (compared to DeFi protocols), withdrawal delays/issues, and uncertainty about the sustainability of the centralized service's business model.

I shall stop here for now. There is simply too much to share about cryptocurrencies.

Net Worth breakdown

Compared to Q2 2019, precious metals allocation increased from 22% to 25% mainly due to the run up in precious metals prices. As I am in the accumulation phase, cryptocurrency allocation increased from 1% to 4%.

As per before, "the pie chart depicts the breakdown in my net worth across the various asset classes in percentage (pie chart neither includes my CPF nor my emergency fund). To be conservative, I computed my precious metals allocation at spot price even though I am holding everything in physicals."

Current Holdings

After converting all my USD and HKD holdings to SGD at the end of the quarter, the following table shows the percentage of each stock from only the equities allocation of my net worth (arranged in descending order).

Debt Levels

Since I've started dabbling in leverage, I have been paying closer attention to my debt levels. Currently, my modified "interest coverage ratio" and "debt-to-equity ratio" is as follows:

Interest Coverage Ratio: 31.32

Debt-to-Equity Ratio: 0.009

With the modified "Interest Coverage Ratio" representing the total amount of cash on hand (excluding emergency funds, interest income, and dividend income) divided by the total debt payable and "Debt-to-Equity Ratio" representing total debt payable divided by equity (what I own outright).

Compared to the previous quarter, there are slight improvements to both metrics as I have been using more cash to pare down my debt levels.

As a result of increasing my allocation towards cryptocurrencies, I have been contributing lesser to our shared emergency fund. The perennial question which I never seem to be able to answer is on the sufficiency of the emergency fund. Is 7 months' worth of emergency fund (assuming liberal spending) sufficient? I really wouldn't know. Hence, there has been some slight guilt on my part for re-allocating funds that could have been placed into the emergency fund into investments instead. Or maybe I am just overworrying on my part.

Capital Allocation Thoughts

With the bleeding cryptocurrencies market, I will be looking to add to volatile coins and lending only a portion of them out. The idea is to replicate the concepts underlying the two charts at the top of my post; building up a snowball of dividend income from different currencies.

On the other hand, I have capped the amount of stable coins in my portfolio. After some discussion with my non-crypto investment blogger friends, it made me realize that, while the yield is good, there is downside risk if the peg breaks. No upside and possibility of downside is not a good combination to possess.

In terms of equities, I will most probably be adding to my existing positions.

Work

I had a serendipitous surprise when my bosses took fragments from various pieces of my work and incorporated them in an in-house research publication. While not as glamorous as a peer-reviewed journal publication, it still is a good boost to my CV. Funny how I would be dying for such an achievement a few years back; today, happiness was merely a momentary bleep.

My priorities have changed.

Recognition for social science publications? Nah.

Pivoting into data science and/or STEM publications (and the accompanying higher remuneration)? Yes Yes Yes!

Studies

Now that the new semester has begun, I will be directing my energies towards this area. Math-heavy modules are no joke!

I have been picking up web development and Solidity programming (Ethereum programming language) informally whenever time permits.

Yes, Enreitch is still chugging along just fine. I've got some ideas to overhaul Enreitch and give it a facelift, but it requires that I step up my programming competency.

Readings

My friend LP expressed his disappointment when I shared that the "Readings" section in my last quarter update may be a one-time thing, lol. I will attempt to keep it alive and try to make it a permanent fixture in my quarterly updates.

In this quarter, I completed the following books:

- Death's End by Liu Cixin (Final book in the Remembrance of Earth's Past Trilogy)

- The Redemption of Time by Baoshu

- Ball Lightning by Liu Cixin

- Waste Tide by Chen Qiufan

- Invisible Planets, edited and translated by Ken Liu

- Kappa Quartet by Daryl Qilin Yam

- The Effective Executive by Peter Drucker

- Barbarians in the Boardroom by Owen Walker

- Business Networking by Will Kintish

This time round, non-fictions are represented too. :P

Special shout-out to Liu Cixin's Ball Lightning which was mind-blowing. Chen Qiufan's Waste Tide was a very good read as well!

First time trying out fiction by Singaporean writers; Daryl Yam's Kappa Quartet had quite a surreal feel to it.

Gaming

All work but no play makesJack Unintelligent Nerd a dull boy right?

The long-awaited game that was on my gaming watchlist, Children of Morta is finally out!

Besides Children of Morta, I have also been playing Dead Cells.

Thanks for reading!

Dividend Income

For my SGD-denominated portfolio, Q3 2019 dividend income registered a slight fall compared to the same quarter of the preceding year. This is to be expected following my partial divestment of Singtel in Q2 2019 (see here). I foresee that changes to my forward SGD-denominated dividend income to be minimal. The REITs and income stocks that I am eyeing are on the high side and I am not willing to add to them.

For my USD-denominated portfolio, dividends received hit a new high again when compared to the same quarter of the preceding year. This is mainly due to capital injections over the past 1 year and some dividend growth during this period.

Transactions

In this quarter, I added to my position in HongKong Land at a PB of 0.34 following the huge drop in price due to the Hong Kong protests. Looking back at my old posts, the last time I added to HongKong Land was in Q4 2018 at a PB of 0.37. Regular readers will know that HongKong Land is one of the pillar stocks in my equities allocation. Still, I'll be looking to add to my position after doing some crude form of risk management (e.g. add to other positions to dilute the significance of HongKong Land in determining my portfolio returns).

I added to gold (jewellery) as a gift to my mum and silver (fortunately before the run-up in precious metal prices).

I closed my position in QAF at a 42% loss (after including dividends) over a period of 2 years and 4 months. A combination of "I don't think I want to wait for their primary production business unit to turn around", "QAF is just a small position in my portfolio (0.69% of equities allocation, based on Q2 2019 post)", and "alternatives with better risk-reward profiles are currently available on the market" contributed to my divestment of QAF.

I guess it is very obvious by now what "alternatives with better risk-reward profiles" refer to.

Hence, in this quarter, I added to Bitcoin, Ether, DAI, and USD Coin (USDC).

Salient points regarding the Ethereum Blockchain

Blogger friends and readers have asked for my take on cryptocurrencies ever since I first mentioned it in my last quarter's update. Now, this is no easy thing to write. Should the post be comprehensive or lighthearted (I have a lighthearted post on Ethereum here)? Should I trace out the history or just share what's new in cryptocurrencies? As I eventually will have to tackle this topic, I think it is high time to do it here, albeit in an abbreviated form with plenty of missing pieces for readers to investigate on their own if they are curious enough.

The Ethereum blockchain has been improving by leaps and bounds, even as the price for Ether trends in the opposite direction. One particular use case that has emerged is Decentralized Finance (DeFi). With this development, ethers and other ethereum-based coins are not held solely for capital gains or losses anymore; coins could be used to participate in a nascent alternative financial system.

For lenders, yields on DeFi platforms are fairly generous. To put this in proper perspective, the risk premium above the risk-free rate is telling enough. These platforms are new, untested, and have yet to suffer a catastrophic failure. For borrowers, DeFi advocates would generally tout the less onerous interest rates compared to traditional borrowing tools like credit cards. I do not engage in any borrowing through DeFi, so my sharing in this area is limited.

I am also quite surprised that the majority of people are not aware of stable coins. Stable coins are cryptocurrencies whose prices do not fluctuate. Critics of cryptocurrencies are often quick to point out that the volatility of cryptocurrencies make for very bad currencies. This is where stable coins come in. It facilitates the transaction of goods and services at a fixed price. Two of the more commonly used stable coins in the DeFi environment are DAI and USDC.

USDC is created by CENTRE, a joint project between Coinbase, a centralized exchange, and Circle. 1 USDC is both backed and pegged to 1 US Dollar (USD). USDC could be purchased at exchanges like Coinbase. Monthly audit reports on the US dollar reserves backing the USDC could be found here on CENTRE's website. The risks associated with using USDC are mainly counterparty risks (if you do not trust Centre, their regulators, audit numbers) and regulatory risk (e.g. authorities adopting a stricter stance against it).

DAI is a decentralized stable coin backed by Ethers. DAI could be obtained through one of two ways: (1) pledging ethers as collaterals to mint DAI, or (2) purchasing DAI minted by others that are sold on the secondary markets. Through a complicated process, 1 DAI is maintained at 1 US Dollar (USD). Hence, DAI is backed by Ethers and pegged to USD. However, there have been occasions where the peg to USD broke. This is one risk that DAI holders should be aware of.

Two of the DeFi protocols which I have been using to earn interest on my stable coins are Compound Finance and dYdX.

Compound Finance functions as a money market fund within the cryptocurrency universe. Cryptocurrencies deposited (both volatile coins as well as stable coin) are lended out to borrowers who borrow through the same platform. Lenders lend to an aggregated pool of a particular asset (e.g. USDC) and it is from this pool that borrowers borrow from. The interest earned from borrowers are spreaded across all lenders regardless of whether their portion of the asset pool have been borrowed. Borrowing from the platform requires overcollateralization. This protects lenders as the borrower's collateral could be liquidated to repay lenders once it falls below a certain threshold.

I have a token sum in the dYdX protocol for diversification (not all eggs in one basket!) and risk management. Other than that, my knowledge of the protocol is superficial.

The dangers of using decentralized services include bugs, hacks, administrative privilege risk, price oracle risk, and liquidity risk.

Besides using decentralized services, I use centralized services as well. Specifically, I am on Crypto.com's Earn program, earning interest from lending out my Ethers.

The main risks associated with using centralized services are hacks, the fear of founders running off with the deposited assets, lack of transparency (compared to DeFi protocols), withdrawal delays/issues, and uncertainty about the sustainability of the centralized service's business model.

I shall stop here for now. There is simply too much to share about cryptocurrencies.

Net Worth breakdown

Compared to Q2 2019, precious metals allocation increased from 22% to 25% mainly due to the run up in precious metals prices. As I am in the accumulation phase, cryptocurrency allocation increased from 1% to 4%.

As per before, "the pie chart depicts the breakdown in my net worth across the various asset classes in percentage (pie chart neither includes my CPF nor my emergency fund). To be conservative, I computed my precious metals allocation at spot price even though I am holding everything in physicals."

Current Holdings

After converting all my USD and HKD holdings to SGD at the end of the quarter, the following table shows the percentage of each stock from only the equities allocation of my net worth (arranged in descending order).

Stock Name

|

Percentage

|

Hongkong

Land

|

8.54

|

AIMS

APAC REIT

|

8.13

|

Frasers

Centrepoint Trust

|

6.70

|

OCBC

Bank

|

6.25

|

Parkway

Life REIT

|

5.85

|

DBS

Group Holdings Ltd

|

4.59

|

The

Tracker Fund of Hong Kong

|

4.52

|

SPH

REIT

|

4.10

|

Mapletree

Industrial Trust

|

4.06

|

First

REIT

|

3.87

|

Thai

Beverage

|

3.27

|

BlackRock

Inc

|

3.27

|

SGX

|

3.14

|

SATS

Ltd

|

2.72

|

Capitaland

Mall Trust

|

2.43

|

Singtel

|

2.35

|

Medtronic

PLC

|

2.22

|

Mapletree

Commercial Trust

|

2.18

|

ST

Engineering

|

2.16

|

Capitaland

Limited

|

1.97

|

Raffles

Medical Group

|

1.91

|

JM

Smucker Co

|

1.66

|

Frasers

Property Limited

|

1.63

|

Japan

Foods Holding Ltd

|

1.62

|

Dairy

Farm International Holdings

|

1.59

|

Frasers

Commercial Trust

|

1.50

|

ISEC

Healthcare Ltd

|

1.34

|

Welltower

Inc

|

1.19

|

Frasers

Logistics & Industrial Trust

|

1.16

|

Sheng

Siong Group Ltd

|

1.06

|

Riverstone

Holdings Limited

|

0.89

|

General

Mills Inc

|

0.69

|

Kraft

Heinz Company

|

0.69

|

Hormel

Foods Corporation

|

0.56

|

Abbott

Laboratories

|

0.21

|

Top 5 positions remained the same, with HongKong Land swapping places with AIMS APAC REIT for the top spot.

As a result of increasing my allocation towards cryptocurrencies, I have been contributing lesser to our shared emergency fund. The perennial question which I never seem to be able to answer is on the sufficiency of the emergency fund. Is 7 months' worth of emergency fund (assuming liberal spending) sufficient? I really wouldn't know. Hence, there has been some slight guilt on my part for re-allocating funds that could have been placed into the emergency fund into investments instead. Or maybe I am just overworrying on my part.

Capital Allocation Thoughts

With the bleeding cryptocurrencies market, I will be looking to add to volatile coins and lending only a portion of them out. The idea is to replicate the concepts underlying the two charts at the top of my post; building up a snowball of dividend income from different currencies.

On the other hand, I have capped the amount of stable coins in my portfolio. After some discussion with my non-crypto investment blogger friends, it made me realize that, while the yield is good, there is downside risk if the peg breaks. No upside and possibility of downside is not a good combination to possess.

In terms of equities, I will most probably be adding to my existing positions.

Work

I had a serendipitous surprise when my bosses took fragments from various pieces of my work and incorporated them in an in-house research publication. While not as glamorous as a peer-reviewed journal publication, it still is a good boost to my CV. Funny how I would be dying for such an achievement a few years back; today, happiness was merely a momentary bleep.

My priorities have changed.

Recognition for social science publications? Nah.

Pivoting into data science and/or STEM publications (and the accompanying higher remuneration)? Yes Yes Yes!

Studies

Now that the new semester has begun, I will be directing my energies towards this area. Math-heavy modules are no joke!

I have been picking up web development and Solidity programming (Ethereum programming language) informally whenever time permits.

Yes, Enreitch is still chugging along just fine. I've got some ideas to overhaul Enreitch and give it a facelift, but it requires that I step up my programming competency.

Readings

My friend LP expressed his disappointment when I shared that the "Readings" section in my last quarter update may be a one-time thing, lol. I will attempt to keep it alive and try to make it a permanent fixture in my quarterly updates.

In this quarter, I completed the following books:

- Death's End by Liu Cixin (Final book in the Remembrance of Earth's Past Trilogy)

- The Redemption of Time by Baoshu

- Ball Lightning by Liu Cixin

- Waste Tide by Chen Qiufan

- Invisible Planets, edited and translated by Ken Liu

- Kappa Quartet by Daryl Qilin Yam

- The Effective Executive by Peter Drucker

- Barbarians in the Boardroom by Owen Walker

- Business Networking by Will Kintish

This time round, non-fictions are represented too. :P

Special shout-out to Liu Cixin's Ball Lightning which was mind-blowing. Chen Qiufan's Waste Tide was a very good read as well!

First time trying out fiction by Singaporean writers; Daryl Yam's Kappa Quartet had quite a surreal feel to it.

Gaming

All work but no play makes

The long-awaited game that was on my gaming watchlist, Children of Morta is finally out!

Besides Children of Morta, I have also been playing Dead Cells.

Thanks for reading!

Friday, September 27, 2019

A whimsical take on Ethereum

The year is 2019. It is a time of magic and wizardry (whizkids). All over the world, wizards have been clandestinely gathering to summon mythical beings from their summoning circles.

Lately, it has been artifacts after artifacts. Strange, columnar objects have begun materializing from the ground up from the summoning circles. These aren't just isolated cases. There have been reports that objects bearing similar characteristics have appeared all over the world (blockchain).

At first, society was baffled and adopted a cautious stance, eyeing the columnar objects from afar. As hesitancy gave way to curiosity, they began to poke and prod it with various tools. It came as a surprise one day when someone found out that writing tools worked on these objects. What made it all the more miraculous was when those same words were found replicated across objects bearing similar characteristics (distributed ledger). Try as they might, words, once written, could not be altered. Henceforth, they became known as global magical books.

There are many such global magical books today. Dear reader, today we will look at one such book: Ethereum.

Initial reception of Ethereum was simple enough. People wrote frivolous stuff on it. Due to its immutable nature, these early words were immortalized for all time. Covertly, entrepreneurial individuals began travelling the world to seek out the multitudinous but similar copies of the Ethereum book. They figured that there was more to it than meets the eye. Their suspicions were confirmed. Books (Ether) were slowly but surely increasing, popping up in strange places all over the world. Second, it could be used to record when money changes hands. It was revolutionary. For once, it meant that humans could travel anywhere, point to a local copy of the book, and engage in financial transactions anywhere.

Travellers who hunt for such books and hoard them became known as adventurers (investors/speculators). Still, peace of mind is a fragile thing and cannot be easily attained. Hence, they handed over some of their books to dwarves to safe-keep in their underground network of caves (miners). Surely this would make it more secure!

Each global magical book has some special characteristics attached to it. Shortly after its discovery, adventurers learned that Ethereum could spawn miniature books with the help of wizards (Initial Coin Offering). These miniature books have special characteristics of their own that may be dissimilar to its parent. Playing with Darwin's roulette, the adventurers and the wizards came together to artificially induce the conception of miniature books. Perhaps there might be novel mutations, they said.

How did playing with Darwin's roulette turn out? It did not turn out well. Growth requires time, something that adventurers could ill afford. In the end, interest waned and people returned back to their daily lives.

Little did the leavers know that there is a stirring in an obscure corner of the world. Some wizards have managed to conjure mana pools (Compound Finance, dYdX) to the delight of adventurers. Energy (interest income) surged through their veins as they drew financial strength from them. Now, fewer visits to the inns were needed to refresh and restock. Still, some have viewed these mana pools with suspicion. What is the source of these pools and how are they sustained? Surely they would dry up one day? These are indeed valid concerns.

Then came the steampunk revolution. Zeppelins became an ubiquitous sight in the azure skies. Some of these pilots saw the opportunity and rendered their services as vigilant eyes over the creation of the wizards (OpenZeppelin Security Audits).

On land, a small proportion of horses began to turn pristine white. Their change culminated in the growth of a single spiralling horn at the centre of their forehead. Like moths to flames, these magical beasts were naturally drawn to the magical books. Some have used them as pathfinders, assisting their riders to locate other magical book holders who are up for a trade (Uniswap Exchange Protocol).

Inspired with the rise of the unicorns, the wizards began poring deeper into the esoteric arts. Tales began to spread of strange creatures (Etheremon, Axie Infinity) roaming the land. Some have surmised that these are the works of wizards, their imaginations made flesh.

Scattered all over the world are the wizarding guilds. Each of them dedicated to find their role in this magically new landscape (MakerDAO, MolochDAO). Slowly but surely, the world is no longer the same. Humble traveller, what would you do?

(Blogger friends and readers have been asking for an Ethereum post. I thought it through long and hard. It had to be easily understandable to the layperson and comprehensive enough. Halfway through, I decided "scratch that, I'll make it memorable" and this is what came out. Hope you had as much fun reading it as I did writing it. Cheers!)

Saturday, August 24, 2019

First Impressions: Axie Infinity (Ethereum Blockchain-based game)

A stray thought entered my mind recently.

"What if I am an early adopter of blockchain-based games?"

The ramifications for the above thought are manifold.

With this in mind, I rallied some of my fellow investment blogger friends who are also gamers to register their interest in such an endeavour.

As not everyone is familiar with cryptocurrencies and blockchains and not everyone is willing to pay to play, I established the following guidelines to help narrow the choices of games down.

1). The game must be fun (subjective, but consensus could easily be reached with just a few of us)

2). The game does not require any "IT skill" (e.g. gamer does not have to create an account on a centralized exchange, buy a small amount of cryptocurrencies, download a browser-based cryptocurrency wallet, transfer cryptocurrencies to the browser-based wallet to access the game, etc)

3). Game must be free-to-play

4). Game must have decent user interface (it must be intuitive for the gamer)

5). Game must not have every aspect of the game as transactions on the blockchain

Unfortunately, none of the above 5 criteria were met in a single game and we had to shelve that idea for now.

Undeterred and still curious, I ventured alone into the strange new world of blockchain gaming.

My first pick was Axie Infinity.

In Axie Infinity, you collect pets known as Axies. You send them out in threes to battle against other teams of 3s and gain experience points. These experience points could be used to upgrade certain features of your Axies (e.g. make your teeth sharper, your tail stronger) to increase their formidability on the battle field or be used to mate with other Axies to produce offsprings.

As the game do not provide new players with Axies, I had to purchase my trio of Axies at the marketplace. In my case, I spent around SGD $4.80 worth of Ether. In retrospect, this may have been a foolish decision. Shouldn't my Axies be earning money for me instead of spending money for me? lol.

Battles between Axie groups are straightforward enough. You select the (1) positioning of the Axie on the battle field, and (2) the order of the moves used in battle. Each move has an offensive and defensive value to it. When an attacking Axie attacks a defending Axie, the offensive value of the attacking Axie's move is somewhat mitigated by the defensive value of the defending Axie's move....or something like that.

You can battle up to 3 times every 12 hours. Every victory and loss nets you 10 and 5 exp, respectively. For people like me who don't watch the battle animation (see screenshot above) play out, you can just skip to the results instantaneously. Hence, time commitment is negligible. Just click battle 3 times in a row and view the results and you are done. You have to give and take a few seconds to find a match online though.

Assuming I require 2400 exp, lose all my battles, and only take part in 3 battles per day instead of 6, I would need 160 days before my Axies accumulate enough experience to breed baby Axies. This process could be hastened by using a pre-battle increased experience buff. As the buff is registered on the ethereum blockchain as a transaction, there is a cost to using it (e.g. ~ SGD $0.01).

Speaking of blockchain transactions, experience earned from battles have to be synced before they can be used. Otherwise, it will be accumulated in a pending state. And yes, syncing entails a transaction on the ethereum blockchain, which means......there is a cost to it. That's why I'm averse to games with plenty of in-game activities that require registering a transaction on the blockchain (point 5 above). The optimal way to manage this is to accumulate a huge amount of experience before syncing them on the blockchain.

Let's revisit this post again 160 days from now. Hopefully, I will have 3 baby Axies that could be sold for SGD $5 worth of Ether and earn a 100% profit! XD

"What if I am an early adopter of blockchain-based games?"

The ramifications for the above thought are manifold.

With this in mind, I rallied some of my fellow investment blogger friends who are also gamers to register their interest in such an endeavour.

As not everyone is familiar with cryptocurrencies and blockchains and not everyone is willing to pay to play, I established the following guidelines to help narrow the choices of games down.

1). The game must be fun (subjective, but consensus could easily be reached with just a few of us)

2). The game does not require any "IT skill" (e.g. gamer does not have to create an account on a centralized exchange, buy a small amount of cryptocurrencies, download a browser-based cryptocurrency wallet, transfer cryptocurrencies to the browser-based wallet to access the game, etc)

3). Game must be free-to-play

4). Game must have decent user interface (it must be intuitive for the gamer)

5). Game must not have every aspect of the game as transactions on the blockchain

Unfortunately, none of the above 5 criteria were met in a single game and we had to shelve that idea for now.

Undeterred and still curious, I ventured alone into the strange new world of blockchain gaming.

My first pick was Axie Infinity.

In Axie Infinity, you collect pets known as Axies. You send them out in threes to battle against other teams of 3s and gain experience points. These experience points could be used to upgrade certain features of your Axies (e.g. make your teeth sharper, your tail stronger) to increase their formidability on the battle field or be used to mate with other Axies to produce offsprings.

As the game do not provide new players with Axies, I had to purchase my trio of Axies at the marketplace. In my case, I spent around SGD $4.80 worth of Ether. In retrospect, this may have been a foolish decision. Shouldn't my Axies be earning money for me instead of spending money for me? lol.

Battles between Axie groups are straightforward enough. You select the (1) positioning of the Axie on the battle field, and (2) the order of the moves used in battle. Each move has an offensive and defensive value to it. When an attacking Axie attacks a defending Axie, the offensive value of the attacking Axie's move is somewhat mitigated by the defensive value of the defending Axie's move....or something like that.

You can battle up to 3 times every 12 hours. Every victory and loss nets you 10 and 5 exp, respectively. For people like me who don't watch the battle animation (see screenshot above) play out, you can just skip to the results instantaneously. Hence, time commitment is negligible. Just click battle 3 times in a row and view the results and you are done. You have to give and take a few seconds to find a match online though.

Assuming I require 2400 exp, lose all my battles, and only take part in 3 battles per day instead of 6, I would need 160 days before my Axies accumulate enough experience to breed baby Axies. This process could be hastened by using a pre-battle increased experience buff. As the buff is registered on the ethereum blockchain as a transaction, there is a cost to using it (e.g. ~ SGD $0.01).

Speaking of blockchain transactions, experience earned from battles have to be synced before they can be used. Otherwise, it will be accumulated in a pending state. And yes, syncing entails a transaction on the ethereum blockchain, which means......there is a cost to it. That's why I'm averse to games with plenty of in-game activities that require registering a transaction on the blockchain (point 5 above). The optimal way to manage this is to accumulate a huge amount of experience before syncing them on the blockchain.

Let's revisit this post again 160 days from now. Hopefully, I will have 3 baby Axies that could be sold for SGD $5 worth of Ether and earn a 100% profit! XD

Friday, August 2, 2019

Fiddling with GIS for Industrial S-REITs

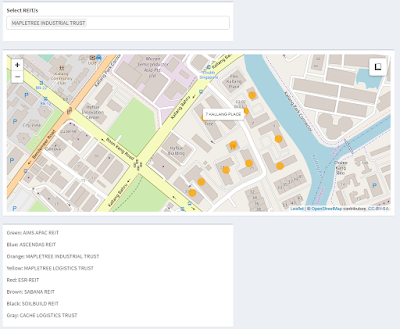

The latest personal project I have been working on is a GIS (Geographic Information System) map detailing the Singapore-based properties of each industrial S-REIT.

The above shows all the Singapore-based properties of each industrial S-REIT.

Too cluttered? Just want to see how spread out Mapletree Industrial Trust's properties are? Sure, you could select Mapletree Industrial Trust only. The choice is yours.

Let's zoom in to some of MIT's Kallang properties.

Hover your mouse cursor over any of the markers and a label will appear detailing the property name (for desktop). For mobile or tablet users, a light tap on a marker will result in the same pop-up. In this case, 7 Kallang Place could be observed in the above screenshot.

Do you need to know the distance from 7 Kallang Place to the main road (or any other place for that matter)?

Place your mouse cursor over/click the "Measure" plug-in at the top right-hand corner of the map. Click on "Create a new measurement", select the points on the map (minimum of 2 points) and, once you are done, select "Finish measurement" and the line will be drawn on the map. Multiple lines can be accommodated. Hence, you can verify whether a given property is located in a much better spot (e.g. in a major transport node) compared to another property for yourself.

Have fun with it here.

Achievement unlocked: Basic competency in Geographic Information System Visualization

To Enreitch users, more positive surprises will be coming your way. :)

Friday, July 5, 2019

Q2 2019 Portfolio Update

How has everyone been? I hope everyone is doing well.

I've been MIA for quite some time. I had an exam paper to clear and have spent quite some time unwinding after my paper. I have recently become acquainted with Chinese Science Fiction (translated to English, thank you) and it has become my new love interest! lol

I digress, financial updates first before I wax lyrical about my readings.

Dividend Income

After a few quarters of tweaking my portfolio, there is finally dividend growth in my SGD-denominated portfolio! Weaker counters have been pruned and, in their place, are stronger counters with more predictable cash flows. I don't think the dividend growth rate is sustainable yet. I have recently sold half of my stake in Singtel and, without a suitable income replacement, I expect dividend income to drop again.

In my USD-denominated portfolio, dividend growth hit a new high this quarter. A huge chunk of the increase came from the position I have been building in Hongkong Land since last year. Organic dividend growth from US dividend aristocrats are still too minuscule to be observed. The positions in BlackRock and Medtronic have also somewhat contributed to the increase. The increase is offsetted with Kraft Heinz's dividend cut. Meanwhile, Welltower REIT and General Mills broke their dividend growth streak, so I do not expect dividend growth from them for some time.

Transactions

In this quarter, I initiated a new smallish position in Riverstone Holdings at a TTM PE of 17.02. I have been eyeing Riverstone for quite some time and the decline in prices allowed me to take a small nibble. From a financials standpoint, Riverstone has a good net profit margin (>10%), ROE (~20ish), and minimal debt. From a historical PE perspective, it remains quite richly valued still. Hence, I have kept this position small as part of my risk management plan. I intend to scale in slowly if the valuation multiple compresses further.

Next, I added to my OCBC position at a Price/NAV of 1.06 using leverage. Similar to my last quarter's purchase of OCBC, the rationale is to increase my exposure to the Singapore banking sector. OCBC was selected as it is undervalued relative to its peers.

As mentioned above, I sold half of my stake in Singtel following the run-up in price towards the end of June. A longer term outlook on their dividends seemed hazy. The intense competition between telcos does not inspire confidence in me. If I am wrong in my analysis, I still have half of my stake in Singtel.

I participated in the Preferential Offering for Frasers Centrepoint Trust and applied for excess units as well. I was allotted all the excess units I applied for. As a result, Frasers Centrepoint Trust now occupies one of the top 5 positions in my equity allocation.

I have also opted for scrip dividends for both OCBC and Raffles Medical Group.

Over at the US side, I exited my entire stake in Kimberly Clark at a TTM PE of 25.59. Kimberly Clark's top-line has been going nowhere, its dividend growth rate has been declining, and earnings are somewhat fueled by share buybacks. Its payout ratio is on the riskier side and I do not want to take any chances. Commentary by management has always been focused on cost-cutting and expense control, which is not something desirable. After holding Kimberly Clark for 2 years and 4 months, my annualized returns are 0.5% (attributed to my small stake and commissions eroding almost all of my returns).

I added to my position in Medtronic at a TTM PE of 24.85. I initiated a small position in Medtronic in Q1 2019. I intend to build this position up slowly.

I initiated a new position in the Tracker Fund of Hong Kong to gain exposure to the Hong Kong market. Initially, I wanted to hand-pick stocks in the HK market as well, but on second thoughts, I realize I do not have the strength nor the time to do so. The HK Tracker Fund should suffice.

I have also added to my silver position in this quarter.

It might come as a surprise to readers, but I've initiated a new position in Ethereum this quarter. In fact, I have been interested in cryptocurrencies even way before the crypto bubble. In one of my old blog posts from 2016, I shared about my readings on the subject. After mainstream consciousness drove the prices of various cryptocurrencies into the stratosphere, I had no choice but to sit on the sidelines. It was not until my friend Rolf's post on the subject made me realize that the crypto market has probably bottomed out and it may be a good time to buy. "Why Ethereum?" could be one of the posts I might consider doing up in the future.

Net Worth breakdown

Compared to Q1 2019, my cash allocation decreased from 41% to 34% mainly due to the purchase of equities in the market sell-off and the payment of my balance transfer debt. Equity allocation increased from 37% to 43%.

As per before, "the pie chart depicts the breakdown in my net worth across the various asset classes in percentage (pie chart neither includes my CPF nor my emergency fund). To be conservative, I computed my precious metals allocation at spot price even though I am holding everything in physicals."

Current Holdings

After converting all my USD and HKD holdings to SGD at the end of the quarter, the following table shows the percentage of each stock from only the equities allocation of my net worth (arranged in descending order).

There has been some changes in my top 5 holdings. Singtel has finally been kicked out of the top 5 (Yay!). DBS was kicked out of the top 5 after I subscribed to Frasers Centrepoint Trust's Preferential Offering, bringing the latter into my top 5. Close at 7th place is the Tracker Fund of Hong Kong. Medtronic's allocation increased from 0.75% from the last quarter to 1.99% this quarter.

REITs have been on a tear lately. Similar to my outlook from the previous quarter, I will still be holding on to them for income. Similarly, the market flow into consumer staples has made it difficult to add to my consumer staples counters. I totally missed out on selected utilities I have been eyeing when the market rebounded.

Debt Levels

I've been MIA for quite some time. I had an exam paper to clear and have spent quite some time unwinding after my paper. I have recently become acquainted with Chinese Science Fiction (translated to English, thank you) and it has become my new love interest! lol

I digress, financial updates first before I wax lyrical about my readings.

Dividend Income

After a few quarters of tweaking my portfolio, there is finally dividend growth in my SGD-denominated portfolio! Weaker counters have been pruned and, in their place, are stronger counters with more predictable cash flows. I don't think the dividend growth rate is sustainable yet. I have recently sold half of my stake in Singtel and, without a suitable income replacement, I expect dividend income to drop again.

In my USD-denominated portfolio, dividend growth hit a new high this quarter. A huge chunk of the increase came from the position I have been building in Hongkong Land since last year. Organic dividend growth from US dividend aristocrats are still too minuscule to be observed. The positions in BlackRock and Medtronic have also somewhat contributed to the increase. The increase is offsetted with Kraft Heinz's dividend cut. Meanwhile, Welltower REIT and General Mills broke their dividend growth streak, so I do not expect dividend growth from them for some time.

Transactions

In this quarter, I initiated a new smallish position in Riverstone Holdings at a TTM PE of 17.02. I have been eyeing Riverstone for quite some time and the decline in prices allowed me to take a small nibble. From a financials standpoint, Riverstone has a good net profit margin (>10%), ROE (~20ish), and minimal debt. From a historical PE perspective, it remains quite richly valued still. Hence, I have kept this position small as part of my risk management plan. I intend to scale in slowly if the valuation multiple compresses further.

Next, I added to my OCBC position at a Price/NAV of 1.06 using leverage. Similar to my last quarter's purchase of OCBC, the rationale is to increase my exposure to the Singapore banking sector. OCBC was selected as it is undervalued relative to its peers.

As mentioned above, I sold half of my stake in Singtel following the run-up in price towards the end of June. A longer term outlook on their dividends seemed hazy. The intense competition between telcos does not inspire confidence in me. If I am wrong in my analysis, I still have half of my stake in Singtel.

I participated in the Preferential Offering for Frasers Centrepoint Trust and applied for excess units as well. I was allotted all the excess units I applied for. As a result, Frasers Centrepoint Trust now occupies one of the top 5 positions in my equity allocation.

I have also opted for scrip dividends for both OCBC and Raffles Medical Group.

Over at the US side, I exited my entire stake in Kimberly Clark at a TTM PE of 25.59. Kimberly Clark's top-line has been going nowhere, its dividend growth rate has been declining, and earnings are somewhat fueled by share buybacks. Its payout ratio is on the riskier side and I do not want to take any chances. Commentary by management has always been focused on cost-cutting and expense control, which is not something desirable. After holding Kimberly Clark for 2 years and 4 months, my annualized returns are 0.5% (attributed to my small stake and commissions eroding almost all of my returns).

I added to my position in Medtronic at a TTM PE of 24.85. I initiated a small position in Medtronic in Q1 2019. I intend to build this position up slowly.

I initiated a new position in the Tracker Fund of Hong Kong to gain exposure to the Hong Kong market. Initially, I wanted to hand-pick stocks in the HK market as well, but on second thoughts, I realize I do not have the strength nor the time to do so. The HK Tracker Fund should suffice.

I have also added to my silver position in this quarter.

It might come as a surprise to readers, but I've initiated a new position in Ethereum this quarter. In fact, I have been interested in cryptocurrencies even way before the crypto bubble. In one of my old blog posts from 2016, I shared about my readings on the subject. After mainstream consciousness drove the prices of various cryptocurrencies into the stratosphere, I had no choice but to sit on the sidelines. It was not until my friend Rolf's post on the subject made me realize that the crypto market has probably bottomed out and it may be a good time to buy. "Why Ethereum?" could be one of the posts I might consider doing up in the future.

Net Worth breakdown

Compared to Q1 2019, my cash allocation decreased from 41% to 34% mainly due to the purchase of equities in the market sell-off and the payment of my balance transfer debt. Equity allocation increased from 37% to 43%.

As per before, "the pie chart depicts the breakdown in my net worth across the various asset classes in percentage (pie chart neither includes my CPF nor my emergency fund). To be conservative, I computed my precious metals allocation at spot price even though I am holding everything in physicals."

Current Holdings

After converting all my USD and HKD holdings to SGD at the end of the quarter, the following table shows the percentage of each stock from only the equities allocation of my net worth (arranged in descending order).

Stock Name

|

Percentage

|

AIMS APAC REIT

|

8.22

|

Hongkong

Land

|

6.57

|

OCBC

Bank

|

6.57

|

Frasers Centrepoint Trust

|

6.39

|

Parkway

Life REIT

|

5.73

|

DBS

Group Holdings Ltd

|

4.91

|

The

Tracker Fund of Hong Kong

|

4.67

|

SPH

REIT

|

4.04

|

First

REIT

|

3.92

|

Mapletree

Industrial Trust

|

3.81

|

BlackRock

Inc

|

3.55

|

Thai

Beverage

|

3.14

|

SGX

|

2.99

|

SATS

Ltd

|

2.96

|

Singtel

|

2.65

|

Capitaland

Mall Trust

|

2.48

|

ST

Engineering

|

2.35

|

Raffles

Medical Group

|

2.01

|

Capitaland

Limited

|

2

|

Medtronic

PLC

|

1.99

|

Mapletree

Commercial Trust

|

1.97

|

Dairy

Farm International Holdings

|

1.82

|

Japan

Foods Holding Ltd

|

1.81

|

JM

Smucker Co

|

1.79

|

Frasers Property Limited

|

1.77

|

Frasers

Commercial Trust

|

1.58

|

ISEC

Healthcare Ltd

|

1.28

|

Frasers

Logistics & Industrial Trust

|

1.14

|

Welltower

Inc

|

1.04

|

Sheng

Siong Group Ltd

|

1.04

|

Riverstone

Holdings Limited

|

0.93

|

Kraft

Heinz Company

|

0.78

|

QAF

Limited

|

0.69

|

General

Mills Inc

|

0.67

|

Hormel

Foods Corporation

|

0.51

|

Abbott

Laboratories

|

0.21

|

REITs have been on a tear lately. Similar to my outlook from the previous quarter, I will still be holding on to them for income. Similarly, the market flow into consumer staples has made it difficult to add to my consumer staples counters. I totally missed out on selected utilities I have been eyeing when the market rebounded.

Debt Levels

Since I've started dabbling in leverage, I have been paying closer attention to my debt levels. Currently, my modified "interest coverage ratio" and "debt-to-equity ratio" is as follows:

Interest Coverage Ratio: 29.67

Debt-to-Equity Ratio: 0.01

With the modified "Interest Coverage Ratio" representing the total amount of cash on hand (excluding emergency funds, interest income, and dividend income) divided by the total debt payable and "Debt-to-Equity Ratio" representing total debt payable divided by equity (what I own outright).

Compared to the previous quarter, my Interest Coverage Ratio has an insignificant drop from 30.35 to 29.67 while my Debt-to-Equity remained the same. Looks like I have been buying more using leverage lately.

Emergency Fund

Same thing month-in, month-out. Stacking cash to build a stronger financial buffer against recession and unemployment.

Insurance

I have also signed up for a term insurance plan with a critical illness rider with Singapore Life. With this addition, I am covered with Hospitalisation & Surgical (H&S) insurance, Personal Accident insurance, and a term insurance plan with a critical illness rider. The underlying motivation to get the new plan is to obtain coverage for an area in which I am lacking - critical illness.

From a cost perspective, it would have been better for me to get a similar plan from Aviva. However, Aviva's customer service and responsiveness just plain sucks. After multiple phone call follow-ups and emails, things were still not moving. In the end, I gave up on them.

The way to get Aviva to move, a blogger friend shared with me, is to expose their inefficiencies on their social media page for all to see. That will definitely get them moving! LOL!

Anyway, I digress. The premium for Singapore Life's term insurance portion is fixed while the critical illness portion escalates with age.

Singapore Life is one of the newer kids on the block, so I did some digging. A cursory search on Google revealed that they acquired the portfolio of Zurich Life when the latter exited their business in Singapore. Singapore Life's shareholders include US Dividend Aristocrat Aflac Inc, which I have came across before.

Work

My contract got renewed to end of Q3 2020. Hence, there is additional visibility in forecasting and allocating cash flow from employment.

Capital Allocation Thoughts

Same as per last quarter, I will be adopting a defensive stance in portfolio management.

I have also begun to think deeper into portfolio construction and the role that each constituent component play in the grand scheme of things:

1). Instead of the STI ETF, would I generate more returns if I invest into an ETF that tracks the Hang Seng Index (e.g. Tracker Fund of Hong Kong). I have come across quite a number of people who bemoaned the "dead-ness" of Singapore's market and the peak growth of Singapore's "bluechips". In contrast, the Chinese market seems to be still growing.

2). Should I convert my SG portfolio into a REIT and bank portfolio since Singapore is a REIT haven and have strong banks (relative to other nations)? With this secure base, I could use the income generated to invest in non-REIT and non-bank market leaders of the various sectors in their respective exchanges to balance things out (e.g. the US market and its dividend aristocrat consumer staples sector, the Malaysian market and its glove industry, Canadian market and its energy sector, etc).

3). Conceptualizing my portfolio as a container of multiple sector ETFs. For example, my nano financials ETF currently consists of DBS, OCBC, SGX, and BlackRock. Should they be equal-weighted? What should be the weight for each component in each nano ETF be? Currently, I'm thinking of overweighting large-cap stocks relative to mid-cap and small-cap stocks for their "apparent safety" (this is not foolproof). What is the maximum cap for each component within a nano ETF and what is the maximum cap for each nano ETF in my overall portfolio?

4). Drawbacks from such an approach include commission fees and complacency pertaining to the destruction of small positions.

5). Now with cryptocurrency in my portfolio, what is the hard cap for it? If there is a mass adoption of cryptocurrencies in the future, what is the middle ground I could take today?

For now, I have some provisional answers to the above questions. As my thoughts have not been fully fleshed out yet, I will refrain from elaborating at this juncture.

In the interim, the focus is on maintaining a healthy level of cash to make occasional purchases when valuation permits. The focus is on sustainable dividends, which could either be used to build my cash position further, pare down debts, or to add to dividend stocks. Once net worth increases, the absolute cap of my allocation towards cryptocurrencies would naturally increase. Setting a cap prevents me from over-investing into cryptocurrencies at any point in time.

Readings

I think I broke my reading record in this quarter, lol. I never was that hungry with investing literature, so you know where my priorities lie, lol.

Books completed:

- The Paper Menagerie and Other Stories by Ken Liu

- Broken Stars, edited and translated by Ken Liu

- The Garden of Evening Mists by Tan Twan Eng

- The Three Body Problem by Liu Cixin (1st book in the Remembrance of Earth's Past Trilogy)

- The Dark Forest by Liu Cixin (2nd book in the Remembrance of Earth's Past Trilogy)

Currently reading:

- Death's End by Liu Cixin (Final book in the Remembrance of Earth's Past Trilogy)

Bought, but haven't read yet:

- Grace of Kings by Ken Liu (1st book in the Dandelion Dynasty Trilogy)

- Wall of Storms by Ken Liu (2nd book in the Dandelion Dynasty Trilogy)

- Ball Lightning by Liu Cixin

- Invisible Planets, edited and translated by Ken Liu

- Waste Tide by Stanley Chan/Chen Qiufan

Man, the reading is damn enjoyable!

Thanks for reading! Time for me to head back to reading! =P

Compared to the previous quarter, my Interest Coverage Ratio has an insignificant drop from 30.35 to 29.67 while my Debt-to-Equity remained the same. Looks like I have been buying more using leverage lately.

Emergency Fund

Same thing month-in, month-out. Stacking cash to build a stronger financial buffer against recession and unemployment.

Insurance

I have also signed up for a term insurance plan with a critical illness rider with Singapore Life. With this addition, I am covered with Hospitalisation & Surgical (H&S) insurance, Personal Accident insurance, and a term insurance plan with a critical illness rider. The underlying motivation to get the new plan is to obtain coverage for an area in which I am lacking - critical illness.

From a cost perspective, it would have been better for me to get a similar plan from Aviva. However, Aviva's customer service and responsiveness just plain sucks. After multiple phone call follow-ups and emails, things were still not moving. In the end, I gave up on them.

The way to get Aviva to move, a blogger friend shared with me, is to expose their inefficiencies on their social media page for all to see. That will definitely get them moving! LOL!

Anyway, I digress. The premium for Singapore Life's term insurance portion is fixed while the critical illness portion escalates with age.

Singapore Life is one of the newer kids on the block, so I did some digging. A cursory search on Google revealed that they acquired the portfolio of Zurich Life when the latter exited their business in Singapore. Singapore Life's shareholders include US Dividend Aristocrat Aflac Inc, which I have came across before.

Work

My contract got renewed to end of Q3 2020. Hence, there is additional visibility in forecasting and allocating cash flow from employment.

Capital Allocation Thoughts

Same as per last quarter, I will be adopting a defensive stance in portfolio management.

I have also begun to think deeper into portfolio construction and the role that each constituent component play in the grand scheme of things:

1). Instead of the STI ETF, would I generate more returns if I invest into an ETF that tracks the Hang Seng Index (e.g. Tracker Fund of Hong Kong). I have come across quite a number of people who bemoaned the "dead-ness" of Singapore's market and the peak growth of Singapore's "bluechips". In contrast, the Chinese market seems to be still growing.

2). Should I convert my SG portfolio into a REIT and bank portfolio since Singapore is a REIT haven and have strong banks (relative to other nations)? With this secure base, I could use the income generated to invest in non-REIT and non-bank market leaders of the various sectors in their respective exchanges to balance things out (e.g. the US market and its dividend aristocrat consumer staples sector, the Malaysian market and its glove industry, Canadian market and its energy sector, etc).

3). Conceptualizing my portfolio as a container of multiple sector ETFs. For example, my nano financials ETF currently consists of DBS, OCBC, SGX, and BlackRock. Should they be equal-weighted? What should be the weight for each component in each nano ETF be? Currently, I'm thinking of overweighting large-cap stocks relative to mid-cap and small-cap stocks for their "apparent safety" (this is not foolproof). What is the maximum cap for each component within a nano ETF and what is the maximum cap for each nano ETF in my overall portfolio?

4). Drawbacks from such an approach include commission fees and complacency pertaining to the destruction of small positions.

5). Now with cryptocurrency in my portfolio, what is the hard cap for it? If there is a mass adoption of cryptocurrencies in the future, what is the middle ground I could take today?

For now, I have some provisional answers to the above questions. As my thoughts have not been fully fleshed out yet, I will refrain from elaborating at this juncture.

In the interim, the focus is on maintaining a healthy level of cash to make occasional purchases when valuation permits. The focus is on sustainable dividends, which could either be used to build my cash position further, pare down debts, or to add to dividend stocks. Once net worth increases, the absolute cap of my allocation towards cryptocurrencies would naturally increase. Setting a cap prevents me from over-investing into cryptocurrencies at any point in time.

Readings

I think I broke my reading record in this quarter, lol. I never was that hungry with investing literature, so you know where my priorities lie, lol.

Books completed:

- The Paper Menagerie and Other Stories by Ken Liu

- Broken Stars, edited and translated by Ken Liu

- The Garden of Evening Mists by Tan Twan Eng

- The Three Body Problem by Liu Cixin (1st book in the Remembrance of Earth's Past Trilogy)

- The Dark Forest by Liu Cixin (2nd book in the Remembrance of Earth's Past Trilogy)

Currently reading:

- Death's End by Liu Cixin (Final book in the Remembrance of Earth's Past Trilogy)

Bought, but haven't read yet:

- Grace of Kings by Ken Liu (1st book in the Dandelion Dynasty Trilogy)

- Wall of Storms by Ken Liu (2nd book in the Dandelion Dynasty Trilogy)

- Ball Lightning by Liu Cixin

- Invisible Planets, edited and translated by Ken Liu

- Waste Tide by Stanley Chan/Chen Qiufan

Man, the reading is damn enjoyable!

Thanks for reading! Time for me to head back to reading! =P

Subscribe to:

Posts (Atom)