Some time back, I came across Five Books, a website that invites authors, academics and public figures from various fields for an interview, where they get asked what five books would they recommend to readers who are interested in their fields.

There is a wide range of books in almost every genre, but as investment blog readers, I guess my readers would be curious as to who have they invited, what transpired in the interviews, and what books were recommended:

Interviews and book recommendations on the topic of "How to Invest"

Interviews and book recommendations on the topic of "Economics"

Interviews and book recommendations on the topic of "Behavioural Economics"

Interviews and book recommendations on the topic of "Finance & Markets"

Interviews and book recommendations on the topic of "Risk"

Interviews and book recommendations on the topic of "Financial Crisis"

Enjoy!

Wednesday, June 13, 2018

Saturday, June 2, 2018

Taking a closer look at Treasury Bills

Plenty of bloggers have turned to the Singapore Savings Bonds (SSBs) as interest rates are on the rise.

Similarly, I have thought of parking my cash in SSBs as well. However, there have been some hesitation on my part. First, a couple of facts about my financial position. My cash position, on absolute terms, is not huge (~$40k). I want a place to park some (not all!) of my cash to earn an interest rate that is higher than the prevailing interest rates offered by your typical savings account. I want a financial product that has a short tenure and can be readily converted back into cash with minimal delay and, if possible, with no penalty inflicted on me.

Some of the current fixed deposit promotions seem decent. However, I do not have multiples of $20k that I could use to create a fixed deposit "ladder." While some offer a short tenure (3 months), I do not fancy the "50% cut" of my cash position. When the market did a faux-turn in Feb this year, I had the experience of terminating my FD early and losing the interest due to my low cash position. I documented my experience here and I do not want to repeat it again.

SSBs are another alternative. What really makes me hesitate here is the application fee and the early redemption fee. Considering that I would hypothetically allocate only a small portion of my cash to it, this move would not make any sense as the application fee and early redemption fee will wipe out the returns. Yes, at this juncture in my life, I neither foresee myself holding the SSBs for the entirety of the 10 years nor put enough cash in it such that the application fee and early redemption fee is a non-issue.

A third option which I am still considering is Treasury Bills (T-Bills). I obtained the data from the Singapore Government Securities website and plotted the following 1-year T-Bill yield chart. Similar to the SSBs, the yield for the 1-year T-Bills have been increasing over time.

Unfortunately (for me), the 3-month and 6-month T-Bills have already been discontinued. What remains is the 1-year T-Bills (which is reflected in the chart above).

Why did I consider T-Bills?

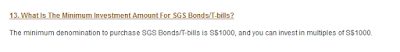

It works for people like me who has limited cash and wants to allocate an even smaller portion of that limited cash to higher-yielding instruments. According to the FAQs for individual investors, the "minimum denomination to purchase SGS Bonds/T-bills is S$1000, and you can invest in multiples of S$1000."

As my broker is DBS, I referred to the link provided. There are no charges that are imposed for applications made via DBS iBanking for SGS (see screenshot below).

Based on the above pieces of information, we know that there are no administrative fees (from CDP's side) and application fees (for those who are using DBS, at least. I did not check for the other two banks) for those that take part in the primary auction.

It is quite rare to hear from bloggers blogging about T-Bills. The only blog post which I have come across is a post by Cory. Interested readers can refer to it.

As for purchasing SGS such as T-Bills from the secondary market, I shall refrain from commenting on it. Partly because I have no experience with it and partly because I suspect that there will be trading fees involved that will eat up the returns.

As it is, if I were to commit a small sum to T-Bills, I would do it via the primary auction route instead of the secondary market route. Dates for primary auctions could be found in SGS's website. As shown in the screenshot below, select "Issuance Calendar", followed by "T-Bills" (if you are interested in T-Bills).

Selecting T-Bills will take you to a separate page which details the T-Bills primary auctions which was/will be conducted in year 2018 (see screenshot below).

Do newly issued T-Bills affect the yields of existing T-Bills that are already on the market? I was curious to find the answer. The following 2 screenshots show the auction results for the 26 January 2018 and 25 April 2018 auctions, respectively.

Similarly, I have thought of parking my cash in SSBs as well. However, there have been some hesitation on my part. First, a couple of facts about my financial position. My cash position, on absolute terms, is not huge (~$40k). I want a place to park some (not all!) of my cash to earn an interest rate that is higher than the prevailing interest rates offered by your typical savings account. I want a financial product that has a short tenure and can be readily converted back into cash with minimal delay and, if possible, with no penalty inflicted on me.

Some of the current fixed deposit promotions seem decent. However, I do not have multiples of $20k that I could use to create a fixed deposit "ladder." While some offer a short tenure (3 months), I do not fancy the "50% cut" of my cash position. When the market did a faux-turn in Feb this year, I had the experience of terminating my FD early and losing the interest due to my low cash position. I documented my experience here and I do not want to repeat it again.

SSBs are another alternative. What really makes me hesitate here is the application fee and the early redemption fee. Considering that I would hypothetically allocate only a small portion of my cash to it, this move would not make any sense as the application fee and early redemption fee will wipe out the returns. Yes, at this juncture in my life, I neither foresee myself holding the SSBs for the entirety of the 10 years nor put enough cash in it such that the application fee and early redemption fee is a non-issue.

A third option which I am still considering is Treasury Bills (T-Bills). I obtained the data from the Singapore Government Securities website and plotted the following 1-year T-Bill yield chart. Similar to the SSBs, the yield for the 1-year T-Bills have been increasing over time.

Unfortunately (for me), the 3-month and 6-month T-Bills have already been discontinued. What remains is the 1-year T-Bills (which is reflected in the chart above).

Why did I consider T-Bills?

It works for people like me who has limited cash and wants to allocate an even smaller portion of that limited cash to higher-yielding instruments. According to the FAQs for individual investors, the "minimum denomination to purchase SGS Bonds/T-bills is S$1000, and you can invest in multiples of S$1000."

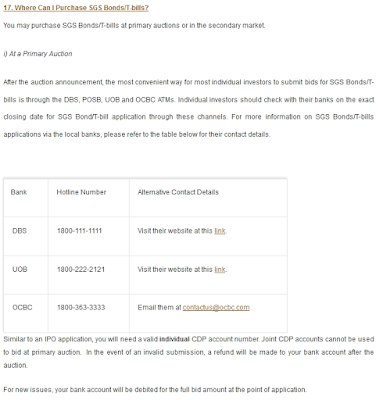

Individuals are able to purchase T-bills at primary auctions or in the secondary market. For purchases made at primary auctions, the details could be found in the screenshot below, which I took from their FAQs for individual investors:

In addition, Singapore Government Securities (SGS) such as Bonds and T-Bills are custodised with the Central Depository (CDP). The FAQ at SGS's website states that "with effect from 1 April 2013, CDP has removed the administrative fees of 0.08% (8 basis points) of the face value of the SGS per annum."

It is quite rare to hear from bloggers blogging about T-Bills. The only blog post which I have come across is a post by Cory. Interested readers can refer to it.

As for purchasing SGS such as T-Bills from the secondary market, I shall refrain from commenting on it. Partly because I have no experience with it and partly because I suspect that there will be trading fees involved that will eat up the returns.

As it is, if I were to commit a small sum to T-Bills, I would do it via the primary auction route instead of the secondary market route. Dates for primary auctions could be found in SGS's website. As shown in the screenshot below, select "Issuance Calendar", followed by "T-Bills" (if you are interested in T-Bills).

Selecting T-Bills will take you to a separate page which details the T-Bills primary auctions which was/will be conducted in year 2018 (see screenshot below).

Do newly issued T-Bills affect the yields of existing T-Bills that are already on the market? I was curious to find the answer. The following 2 screenshots show the auction results for the 26 January 2018 and 25 April 2018 auctions, respectively.

If you look at the T-Bill yield chart at the very top of this blog post, the T-Bill yield at 31 January 2018 and 30 April 2018 are 1.38% and 1.74%, respectively.

In theory, the market will readjust itself to the yield of the newly issued T-Bills. We see that this is the case when the bond market closed on 31 January 2018; the newly issued T-Bills yielded 1.38% and the historical data showed the same figure.

However, reality did not corroborate theory on 30 April 2018. The newly issued T-Bill yielded 1.76% while the historical data showed 1.74%.

Market forces push SGS prices and yields up or down. Accordingly, it could be inferred that investment capital is not guaranteed (but still relatively safe as it is the Singapore Government we are talking about here), unless one holds all the way to maturity. For investors who require a capital guaranteed instrument, they could consider sticking with SSBs.

As for myself, I'm still contemplating whether are T-Bills a suitable financial instrument for me to use. If I do use them, I have to be certain that I will be holding them for the full duration, since a rising interest rate environment will see money flow towards newer T-Bill issuances. For now, I'll wait and see how the July 2018 issuance turns out!

Subscribe to:

Posts (Atom)