Goodbye 2018! Hello 2019!

I must be in the flow today. I can't stop typing as the words just come to me. As the post is getting lengthy, I'll be splitting it into two posts.

Dividend Income

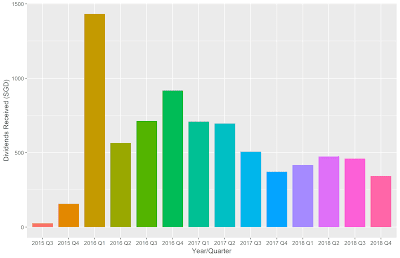

Dividends received from my SGD-denominated portfolio in Q4 2018 fell, when compared to the same quarter last year. Most likely, this is due to the effect of pruning quite a number of counters from my portfolio which I had started 2 quarters ago. I expect increases in my dividend income for the coming year once the new additions to my portfolio start contributing their part.

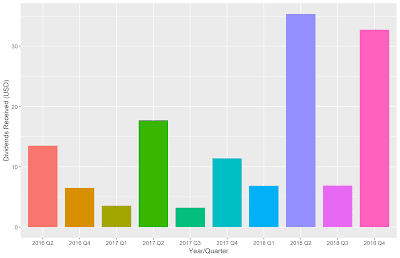

Dividends received from my USD-denominated portfolio increased in Q4 2018, when compared to the same quarter last year. I have been allocating more cash, albeit slowly, to my USD-denominated portfolio. The US market has fallen quite a bit and I am initiating new positions and adding to my existing positions slowly if the market continues to slide further. The main thrust of my USD-denominated portfolio is on dividend growth.

I get this question often, so I hope to address it here. The framework that I adopt in my equities allocation involves selecting higher-yielding SG income stocks with lower dividend growth potential and complementing it with lower-yielding US dividend growth stocks with higher dividend growth potential. So far, this framework works fine for me. Cash flow from SG stocks could be used to purchase additional cash flow from SG stocks or US dividend growth stocks whose dividend increases would materialize somewhere in the future.

Yes, the 30% dividend withholding tax does stick out like a sore thumb. The seemingly punitive withholding tax doesn't look that bad after all when said US dividend growth stocks generate upper single digit or double digit growth and dividend growth. I am cherry picking here, but did you know that a certain US dividend aristocrat had a sustainable 28% dividend increase this year? How many SG income stocks could grow their dividends around low-to-mid single digit each year and pull out a tremendous sustainable 28% increase in a particular year? Please share with me if you do know of any.

Unfortunately, there is a difference between theory and praxis. I think quite a few of my US dividend growth stocks which I have selected turned out to be duds by having their dividend growth streaks broken. Second, the Singapore market do have their dividend growth stocks as well. They do not possess the kind of insane dividend growth that their US counterparts possess, but dividend growth is still dividend growth. It is a failing on my part to assume that they do not exist and my obstinacy to not challenging the assumption I had as well as my lack of meticulousness in scouring the SG market to confirm/disconfirm my thesis.

Oh well. I will improve from here.

Transactions

From this quarter onwards, I will be including a valuation metric to each of my purchase transactions. This is mainly for my own record keeping.

I initiated a new, smallish position in Kraft Heinz at TTM PE of 15.35 prior to their Q3 earnings. I had some qualms regarding my decision as Kraft Heinz's payout ratio is on the high side and the management had been silent regarding the much-expected dividend increase in their Q2 earnings. Still, I decided to go for it, foolishly believing that Warren Buffett and 3G Capital will work their magic and help the company to resume growth. When the supposed dividend increase failed to materialize for the second time round following their Q3 earnings, the price crashed by 10%.

I added to my position in Hongkong Land at a PB of 0.37 when it fell to its 52-week low. Nothing much to add here. Regular readers would know that I hold Hongkong Land for its recurring cashflow from its investment properties.

I added to my position in SATS twice in this quarter. Once at TTM PE of 20.55 and another time at TTM PE of 20.51. The rationale is to diversify my income sources away from REITs, which still form a large portion of my equity allocation. As SATS is still at the upper end of its valuation (by PE), these two additions are kept small in size as part of my risk management plan (despite SATS' horrible technicals lately). SATS was also the counter I used in my maiden experiment with leverage (see section on "Leverage" below).

I sold my entire stake in Yeo Hiap Seng at a 25% loss. Thanks to position sizing, the impact was minimal. There are two lessons from this episode. First, blanket statements such as "consumer staples are defensive/recession-resistant" and "people need to eat and drink" need to be qualified. Consumer staples need to be evaluated both quantitatively (trend in their various metrics) and qualitatively (are their products relevant to the modern day consumer, etc) against each other to identify the better performing ones. Second, I purchased Yeo Hiap Seng as a consumer staples stock. That was my somewhat flimsy investment thesis. Subsequently, I learned of Yeo Hiap Seng's freehold properties and, gradually, engaged in mental gymnastics to accommodate "asset play" as part of my investment thesis. I have been aware of this for quite some time, but it isn't until recently that I acted on it.

I initiated a new small position in DBS to gain additional exposure to the financial sector. I have been avoiding the financial sector for fears that they will be hit the hardest in a market crash. Ironically, my obstinacy to ignore Singapore's banking sector for the above reason made me blind to the fact that DBS exhibits some form of dividend growth.

I added to my position in First REIT when the market was pessimistic about it. I will be observing how the Lippo Karawaci-First REIT tenancy issue works out.

I initiated a new small position in BlackRock Inc at TTM PE of 13.84. Thanks to the falling market, BlackRock has lost about 36% from its peak. Woot! :D Market leader, consistently high net margins, improving ROE, increasing top and bottom line, increasing dividends, a sustainable payout ratio, decreasing share count, and........in a time of cheap debt and crazy corporate leverage, BlackRock has an almost pristine balance sheet. What more could I possibly want? During the GFC, BlackRock had the financial strength to increase their dividends but did not do so. Instead, it maintained its dividends and, as a result, lost its dividend growth streak. Currently, BlackRock spots a dividend growth streak of 9 years.

I initiated a new small position in Frasers Logistics & Industrial Trust at a P/NAV of 1.07 using balance transfer. I have been looking for opportunities to initiate positions in large-cap REITs and the recent fall in price allowed me to do so. It is also encouraging to note that Frasers Logistics & Industrial Trust has demonstrated some form of dividend growth thus far based on its limited track record.

I added to physical silver in this quarter as well.

Leverage

I signed up for my first credit card this quarter. The supposed end goal is to build up my non-existent credit rating and, from there, to employ balance transfer to leverage up and buy shares.

I've learned this from a friend who frequents the investment blogosphere. He has used this method effectively during the GFC to build up a sizable investment portfolio. This form of leverage is "safer" as no margin calls are involved. To play it cautious, I have borrowed amounts that I could immediately afford to pay back.

For those who are unfamiliar, balance transfer is a type of credit facility offered by credit card companies to help indebted individuals to clear their debt. The general idea is to borrow at 0% interest for a given period of time (e.g. 6 months, 1 year, etc) to pay back your other debts. There is an administrative charge to borrow at 0% interest which has to be paid upfront.

Instead of borrowing using balance transfer to pay down debts, I used the proceeds to purchase shares. As there is an administrative charge, the shares to be purchased has to yield higher than the administrative charge for it to make sense. Obviously, using the balance transfer method for REITs will be more appealing as the spread between REIT yields and the administrative charge is much wider. In addition, REITs pay out their distributions on a quarterly basis. This will help the user to pay down the balance transfer debt faster compared to non-REITs which pay out semi-annually. This process can be repeated to speed up the process of accumulating assets. Second, the user would have otherwise missed out on a few distributions if he or she had to save up for a couple more months to purchase the REIT.

The successful use of balance transfer to buy shares is underpinned by two critical assumptions. One, the investor has to be a good stock picker. There is no point in accumulating mediocre assets that generate decreasing cash flow or have a higher propensity to result in capital losses. In this regard, I would fail as my stock picking skills is so-so. Second, valuation still applies. One cannot simply anyhow whack regardless of valuation.

In terms of overall portfolio risk management, I have came up with the following provisional guidelines with regards to the use of balance transfer for stock purchases:

- Only use Balance Transfer for the purchase of Large-cap stocks (higher probabilities of large-cap stocks surviving an economic downturn)

- Rotate between various stocks (prevent portfolio from being too skewed to a particular stock/particular group of stocks)

- Set a time gap between each use of balance transfer (prevent myself from being too trigger-happy). I have not decided on a suitable time gap yet, but I am thinking of setting a 1 month gap.

Administrative Updates

As mentioned in my previous quarter's update, I have created a trading account to trade Hong Kong stocks and another trading account to trade Singapore stocks (in the event that my main Singapore trading account fails when everyone is trying to exit their positions in a market crash). Back then, follow-up actions include creating a Malaysia trading account and a Denmark trading account to trade Malaysian and Denmark stocks, respectively.

In this quarter, I have opened a Malaysian stock trading account while the Denmark stock trading account opening remains undone.

Okay, this post is getting quite lengthy. I shall stop here and continue in another post. In the next post, I will touch on my net worth breakdown, my returns for the year, some miscellaneous stuff (insurance coverage, work, studies, emergency fund, mother's retirement fund), my stock holdings, and my investment strategy. That's all for now. Thanks for reading!

Sunday, December 30, 2018

Wednesday, December 12, 2018

Staycation at Yotel Singapore

There has been some changes to the flexible benefits policy at my workplace. The number of categories that we could spend on have been restricted to only a select few, with staycations being one of them. After going for my first staycation, it's now safe to say that I've caught the staycation bug! It is good to take a well-deserved break, to empty my mind, and to live in the present. Also, it is fun being a tourist in Singapore.

Recently, I spent some of my flexible benefits at Yotel Singapore. By the way, this is not a sponsored post.

Yotel Singapore is a newly-opened hotel in the heart of Orchard road. Their main draw is their futuristic theme and their guest service robots, Yoshi and Yolanda. Families with kids will definitely enjoy dialing up Mission Control (reception) for either Yoshi or Yolanda to deliver items such as towels and water bottles to your room. No, I did not spam requests, lol; I only tried it out once. Apparently, Yolanda occasionally sings to hotel guests after a delivery request, but I was not lucky enough to hear her sing. :(

Befitting its futuristic theme, you could self check-in at one of the counters in the lobby. Fill in your details, swap your credit card, and you are able to create your own room key on the spot. Kudos to the front desk staff who came to greet and welcome us.

The bedroom area is separated from the wash area by frosted glass.

Until next time folks. My staycation watchlist has been firmed up and I am looking forward to my next adventure. :)

Recently, I spent some of my flexible benefits at Yotel Singapore. By the way, this is not a sponsored post.

Yotel Singapore is a newly-opened hotel in the heart of Orchard road. Their main draw is their futuristic theme and their guest service robots, Yoshi and Yolanda. Families with kids will definitely enjoy dialing up Mission Control (reception) for either Yoshi or Yolanda to deliver items such as towels and water bottles to your room. No, I did not spam requests, lol; I only tried it out once. Apparently, Yolanda occasionally sings to hotel guests after a delivery request, but I was not lucky enough to hear her sing. :(

We stayed in the Premium Queen View room which was located on the higher floors with good views of Orchard road. The room was slightly smaller compared to your typical hotel rooms. Despite its small size, the space is efficiently used. The rooms come packed with a fridge, safe, iron, ironing board, and hair dryer. The bed is adjustable and you can adjust the angle to suit your comfort level.

The bedroom area is separated from the wash area by frosted glass.

As we were located on the higher floors, we had a good view of Orchard road. Unless you want your net tangible assets to be in the public's eye, do remember to draw down the blinds while using the wash area.

At level 10, we have the Komyuniti Bar and Restaurant, the gym, and the pool area.

A pity I didn't managed to get good shots of the breakfast spread though. Only one came out "decent."

I enjoyed the KOMpliment (the Yotel signature cocktail) that consists of butterfly pea flower-infused gin, fresh lemon, violet liqueur, egg white, hibiscus perfume & orange bitters.

Until next time folks. My staycation watchlist has been firmed up and I am looking forward to my next adventure. :)

Subscribe to:

Posts (Atom)