Goodbye 2018! Hello 2019!

I must be in the flow today. I can't stop typing as the words just come to me. As the post is getting lengthy, I'll be splitting it into two posts.

Dividend Income

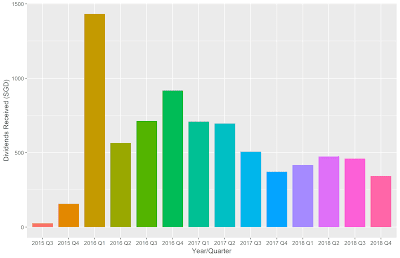

Dividends received from my SGD-denominated portfolio in Q4 2018 fell, when compared to the same quarter last year. Most likely, this is due to the effect of pruning quite a number of counters from my portfolio which I had started 2 quarters ago. I expect increases in my dividend income for the coming year once the new additions to my portfolio start contributing their part.

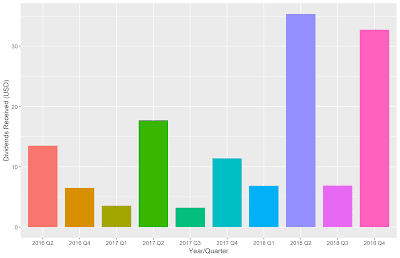

Dividends received from my USD-denominated portfolio increased in Q4 2018, when compared to the same quarter last year. I have been allocating more cash, albeit slowly, to my USD-denominated portfolio. The US market has fallen quite a bit and I am initiating new positions and adding to my existing positions slowly if the market continues to slide further. The main thrust of my USD-denominated portfolio is on dividend growth.

I get this question often, so I hope to address it here. The framework that I adopt in my equities allocation involves selecting higher-yielding SG income stocks with lower dividend growth potential and complementing it with lower-yielding US dividend growth stocks with higher dividend growth potential. So far, this framework works fine for me. Cash flow from SG stocks could be used to purchase additional cash flow from SG stocks or US dividend growth stocks whose dividend increases would materialize somewhere in the future.

Yes, the 30% dividend withholding tax does stick out like a sore thumb. The seemingly punitive withholding tax doesn't look that bad after all when said US dividend growth stocks generate upper single digit or double digit growth and dividend growth. I am cherry picking here, but did you know that a certain US dividend aristocrat had a sustainable 28% dividend increase this year? How many SG income stocks could grow their dividends around low-to-mid single digit each year and pull out a tremendous sustainable 28% increase in a particular year? Please share with me if you do know of any.

Unfortunately, there is a difference between theory and praxis. I think quite a few of my US dividend growth stocks which I have selected turned out to be duds by having their dividend growth streaks broken. Second, the Singapore market do have their dividend growth stocks as well. They do not possess the kind of insane dividend growth that their US counterparts possess, but dividend growth is still dividend growth. It is a failing on my part to assume that they do not exist and my obstinacy to not challenging the assumption I had as well as my lack of meticulousness in scouring the SG market to confirm/disconfirm my thesis.

Oh well. I will improve from here.

Transactions

From this quarter onwards, I will be including a valuation metric to each of my purchase transactions. This is mainly for my own record keeping.

I initiated a new, smallish position in Kraft Heinz at TTM PE of 15.35 prior to their Q3 earnings. I had some qualms regarding my decision as Kraft Heinz's payout ratio is on the high side and the management had been silent regarding the much-expected dividend increase in their Q2 earnings. Still, I decided to go for it, foolishly believing that Warren Buffett and 3G Capital will work their magic and help the company to resume growth. When the supposed dividend increase failed to materialize for the second time round following their Q3 earnings, the price crashed by 10%.

I added to my position in Hongkong Land at a PB of 0.37 when it fell to its 52-week low. Nothing much to add here. Regular readers would know that I hold Hongkong Land for its recurring cashflow from its investment properties.

I added to my position in SATS twice in this quarter. Once at TTM PE of 20.55 and another time at TTM PE of 20.51. The rationale is to diversify my income sources away from REITs, which still form a large portion of my equity allocation. As SATS is still at the upper end of its valuation (by PE), these two additions are kept small in size as part of my risk management plan (despite SATS' horrible technicals lately). SATS was also the counter I used in my maiden experiment with leverage (see section on "Leverage" below).

I sold my entire stake in Yeo Hiap Seng at a 25% loss. Thanks to position sizing, the impact was minimal. There are two lessons from this episode. First, blanket statements such as "consumer staples are defensive/recession-resistant" and "people need to eat and drink" need to be qualified. Consumer staples need to be evaluated both quantitatively (trend in their various metrics) and qualitatively (are their products relevant to the modern day consumer, etc) against each other to identify the better performing ones. Second, I purchased Yeo Hiap Seng as a consumer staples stock. That was my somewhat flimsy investment thesis. Subsequently, I learned of Yeo Hiap Seng's freehold properties and, gradually, engaged in mental gymnastics to accommodate "asset play" as part of my investment thesis. I have been aware of this for quite some time, but it isn't until recently that I acted on it.

I initiated a new small position in DBS to gain additional exposure to the financial sector. I have been avoiding the financial sector for fears that they will be hit the hardest in a market crash. Ironically, my obstinacy to ignore Singapore's banking sector for the above reason made me blind to the fact that DBS exhibits some form of dividend growth.

I added to my position in First REIT when the market was pessimistic about it. I will be observing how the Lippo Karawaci-First REIT tenancy issue works out.

I initiated a new small position in BlackRock Inc at TTM PE of 13.84. Thanks to the falling market, BlackRock has lost about 36% from its peak. Woot! :D Market leader, consistently high net margins, improving ROE, increasing top and bottom line, increasing dividends, a sustainable payout ratio, decreasing share count, and........in a time of cheap debt and crazy corporate leverage, BlackRock has an almost pristine balance sheet. What more could I possibly want? During the GFC, BlackRock had the financial strength to increase their dividends but did not do so. Instead, it maintained its dividends and, as a result, lost its dividend growth streak. Currently, BlackRock spots a dividend growth streak of 9 years.

I initiated a new small position in Frasers Logistics & Industrial Trust at a P/NAV of 1.07 using balance transfer. I have been looking for opportunities to initiate positions in large-cap REITs and the recent fall in price allowed me to do so. It is also encouraging to note that Frasers Logistics & Industrial Trust has demonstrated some form of dividend growth thus far based on its limited track record.

I added to physical silver in this quarter as well.

Leverage

I signed up for my first credit card this quarter. The supposed end goal is to build up my non-existent credit rating and, from there, to employ balance transfer to leverage up and buy shares.

I've learned this from a friend who frequents the investment blogosphere. He has used this method effectively during the GFC to build up a sizable investment portfolio. This form of leverage is "safer" as no margin calls are involved. To play it cautious, I have borrowed amounts that I could immediately afford to pay back.

For those who are unfamiliar, balance transfer is a type of credit facility offered by credit card companies to help indebted individuals to clear their debt. The general idea is to borrow at 0% interest for a given period of time (e.g. 6 months, 1 year, etc) to pay back your other debts. There is an administrative charge to borrow at 0% interest which has to be paid upfront.

Instead of borrowing using balance transfer to pay down debts, I used the proceeds to purchase shares. As there is an administrative charge, the shares to be purchased has to yield higher than the administrative charge for it to make sense. Obviously, using the balance transfer method for REITs will be more appealing as the spread between REIT yields and the administrative charge is much wider. In addition, REITs pay out their distributions on a quarterly basis. This will help the user to pay down the balance transfer debt faster compared to non-REITs which pay out semi-annually. This process can be repeated to speed up the process of accumulating assets. Second, the user would have otherwise missed out on a few distributions if he or she had to save up for a couple more months to purchase the REIT.

The successful use of balance transfer to buy shares is underpinned by two critical assumptions. One, the investor has to be a good stock picker. There is no point in accumulating mediocre assets that generate decreasing cash flow or have a higher propensity to result in capital losses. In this regard, I would fail as my stock picking skills is so-so. Second, valuation still applies. One cannot simply anyhow whack regardless of valuation.

In terms of overall portfolio risk management, I have came up with the following provisional guidelines with regards to the use of balance transfer for stock purchases:

- Only use Balance Transfer for the purchase of Large-cap stocks (higher probabilities of large-cap stocks surviving an economic downturn)

- Rotate between various stocks (prevent portfolio from being too skewed to a particular stock/particular group of stocks)

- Set a time gap between each use of balance transfer (prevent myself from being too trigger-happy). I have not decided on a suitable time gap yet, but I am thinking of setting a 1 month gap.

Administrative Updates

As mentioned in my previous quarter's update, I have created a trading account to trade Hong Kong stocks and another trading account to trade Singapore stocks (in the event that my main Singapore trading account fails when everyone is trying to exit their positions in a market crash). Back then, follow-up actions include creating a Malaysia trading account and a Denmark trading account to trade Malaysian and Denmark stocks, respectively.

In this quarter, I have opened a Malaysian stock trading account while the Denmark stock trading account opening remains undone.

Okay, this post is getting quite lengthy. I shall stop here and continue in another post. In the next post, I will touch on my net worth breakdown, my returns for the year, some miscellaneous stuff (insurance coverage, work, studies, emergency fund, mother's retirement fund), my stock holdings, and my investment strategy. That's all for now. Thanks for reading!

Sunday, December 30, 2018

Wednesday, December 12, 2018

Staycation at Yotel Singapore

There has been some changes to the flexible benefits policy at my workplace. The number of categories that we could spend on have been restricted to only a select few, with staycations being one of them. After going for my first staycation, it's now safe to say that I've caught the staycation bug! It is good to take a well-deserved break, to empty my mind, and to live in the present. Also, it is fun being a tourist in Singapore.

Recently, I spent some of my flexible benefits at Yotel Singapore. By the way, this is not a sponsored post.

Yotel Singapore is a newly-opened hotel in the heart of Orchard road. Their main draw is their futuristic theme and their guest service robots, Yoshi and Yolanda. Families with kids will definitely enjoy dialing up Mission Control (reception) for either Yoshi or Yolanda to deliver items such as towels and water bottles to your room. No, I did not spam requests, lol; I only tried it out once. Apparently, Yolanda occasionally sings to hotel guests after a delivery request, but I was not lucky enough to hear her sing. :(

Befitting its futuristic theme, you could self check-in at one of the counters in the lobby. Fill in your details, swap your credit card, and you are able to create your own room key on the spot. Kudos to the front desk staff who came to greet and welcome us.

The bedroom area is separated from the wash area by frosted glass.

Until next time folks. My staycation watchlist has been firmed up and I am looking forward to my next adventure. :)

Recently, I spent some of my flexible benefits at Yotel Singapore. By the way, this is not a sponsored post.

Yotel Singapore is a newly-opened hotel in the heart of Orchard road. Their main draw is their futuristic theme and their guest service robots, Yoshi and Yolanda. Families with kids will definitely enjoy dialing up Mission Control (reception) for either Yoshi or Yolanda to deliver items such as towels and water bottles to your room. No, I did not spam requests, lol; I only tried it out once. Apparently, Yolanda occasionally sings to hotel guests after a delivery request, but I was not lucky enough to hear her sing. :(

We stayed in the Premium Queen View room which was located on the higher floors with good views of Orchard road. The room was slightly smaller compared to your typical hotel rooms. Despite its small size, the space is efficiently used. The rooms come packed with a fridge, safe, iron, ironing board, and hair dryer. The bed is adjustable and you can adjust the angle to suit your comfort level.

The bedroom area is separated from the wash area by frosted glass.

As we were located on the higher floors, we had a good view of Orchard road. Unless you want your net tangible assets to be in the public's eye, do remember to draw down the blinds while using the wash area.

At level 10, we have the Komyuniti Bar and Restaurant, the gym, and the pool area.

A pity I didn't managed to get good shots of the breakfast spread though. Only one came out "decent."

I enjoyed the KOMpliment (the Yotel signature cocktail) that consists of butterfly pea flower-infused gin, fresh lemon, violet liqueur, egg white, hibiscus perfume & orange bitters.

Until next time folks. My staycation watchlist has been firmed up and I am looking forward to my next adventure. :)

Tuesday, October 30, 2018

Applying the Chowder Rule metric to S-REITs

In today's post, I will not show you where to get the tastiest, most value-for-money Chowder in Singapore. That is.......the responsibility of food bloggers.

Instead, I will introduce you to the Chowder Rule, so named after Chowder, a Seeking Alpha contributor. I will be lifting several paragraphs from an article by Sure Dividend on the same topic:

The Chowder Rule is a rule-based system used to identify dividend growth stocks with strong total return potential by combining dividend yield and dividend growth. The Chowder Rule is applied in a differentiated manner depending on the type of stock in question. The criteria can be found below:

Rule 1: If a stock has a dividend yield greater than 3%, its 5-year dividend growth rate plus its dividend yield must be greater than 12%.

Rule 2: If a stock has a dividend yield less than 3%, its 5-year dividend growth rate plus its dividend yield must be greater than 15%.

Rule 3: If a stock is a utility, its 5-year dividend growth rate plus its dividend yield must be greater than 8%.

For those who are interested in the details (its underlying philosophy, when to use it, its limitations, etc), you can read more of the Chowder Rule here.

The first thought that I had when I came across the Chowder Rule a couple of weeks back was to apply the metric to S-REITs. The rationale is to add another tool to my investment toolkit to help me differentiate whether does a particular REIT make the cut.

As you can see, all 3 rules do not make explicit allowances for REITs. Hence, I took the liberty to select Rule 3 and apply it to S-REITs (based on the assumption that REITs and utilities share similarities such as being higher-yielding, lower growth/dividend growth instruments).

I then realized that there might be certain REITs who could "pass" the Chowder Rule 3 of 8% just for being higher-yielding. Perhaps, in our situation, we could use the Chowder Rule not as a binary measure (e.g. above 8% = good; below 8% = bad), but as a a relative measure (e.g. REIT A has a higher score than REIT B).

In the calculations that follow, annual dividends will be defined as the total dividends distributed by any given REIT in their financial year, not the calendar year. Special dividends, if any, will be included in the computation of dividend growth. Data will be taken from the most recent annual report. Current dividend yield will be taken from the REIT Data site at the time of this blog post (30 October 2018).

With d referring to total dividends distributed in the financial year and y referring to the current year, let 5-year dividend growth rate be:

((dy - dy-1)/dy-1+(dy-1 - dy-2)/dy-2+(dy-2 - dy-3)/dy-3+(dy-3 - dy-4)/dy-4+(dy-4 - dy-5)/dy-5)/5

I won't be calculating the Chowder Rule for all the REITs; I will only be looking at a select few REITs.

AIMS AMP Capital Industrial REIT

5-year dividend growth rate: -1.12%

Current dividend yield: 7.741%

Chowder Rule value: 6.62%

Ascendas REIT

5-year dividend growth rate: 3.08%

Current dividend yield: 6.272%

Chowder Rule value: 9.35%

Capitaland Commercial Trust

5-year dividend growth rate: 1.56%

Current dividend yield: 4.767%

Chowder Rule value: 6.33%

Capitaland Mall Trust

5-year dividend growth rate: 3.42%

Current dividend yield: 5.264%

Chowder Rule value: 8.68%

First REIT

5-year dividend growth rate: 3.39%

Current dividend yield: 7.142%

Chowder Rule value: 10.53%

Frasers Centrepoint Trust

5-year dividend growth rate: 3.56%

Current dividend yield: 5.586%

Chowder Rule value: 9.15%

Keppel REIT

5-year dividend growth rate: -5.92%

Current dividend yield: 5.062%

Chowder Rule value: -0.86%

Lippo Mall Trust

5-year dividend growth rate: 3.66%

Current dividend yield: 14.044%

Chowder Rule value: 17.70%

Mapletree Commercial Trust

5-year dividend growth rate: 6.94%

Current dividend yield: 5.644%

Chowder Rule value: 12.58%

Mapletree Industrial Trust

5-year dividend growth rate: 4.94%

Current dividend yield: 6.194%

Chowder Rule value: 11.13%

Mapletree Logistics Trust

5-year dividend growth rate: 2.16%

Current dividend yield: 6.252%

Chowder Rule value: 8.41%

Parkway Life REIT

5-year dividend growth rate: 5.63%

Current dividend yield: 4.773%

Chowder Rule value: 10.40%

Sabana REIT

5-year dividend growth rate: -17.65%

Current dividend yield: 8.329%

Chowder Rule value: -9.32%

Starhill Global REIT

5-year dividend growth rate: 0.99%

Current dividend yield: 6.977%

Chowder Rule value: 7.97%

Make what you will of these figures. Have fun!

|

| ....Not today's subject |

Instead, I will introduce you to the Chowder Rule, so named after Chowder, a Seeking Alpha contributor. I will be lifting several paragraphs from an article by Sure Dividend on the same topic:

The Chowder Rule is a rule-based system used to identify dividend growth stocks with strong total return potential by combining dividend yield and dividend growth. The Chowder Rule is applied in a differentiated manner depending on the type of stock in question. The criteria can be found below:

Rule 1: If a stock has a dividend yield greater than 3%, its 5-year dividend growth rate plus its dividend yield must be greater than 12%.

Rule 2: If a stock has a dividend yield less than 3%, its 5-year dividend growth rate plus its dividend yield must be greater than 15%.

Rule 3: If a stock is a utility, its 5-year dividend growth rate plus its dividend yield must be greater than 8%.

For those who are interested in the details (its underlying philosophy, when to use it, its limitations, etc), you can read more of the Chowder Rule here.

The first thought that I had when I came across the Chowder Rule a couple of weeks back was to apply the metric to S-REITs. The rationale is to add another tool to my investment toolkit to help me differentiate whether does a particular REIT make the cut.

As you can see, all 3 rules do not make explicit allowances for REITs. Hence, I took the liberty to select Rule 3 and apply it to S-REITs (based on the assumption that REITs and utilities share similarities such as being higher-yielding, lower growth/dividend growth instruments).

I then realized that there might be certain REITs who could "pass" the Chowder Rule 3 of 8% just for being higher-yielding. Perhaps, in our situation, we could use the Chowder Rule not as a binary measure (e.g. above 8% = good; below 8% = bad), but as a a relative measure (e.g. REIT A has a higher score than REIT B).

In the calculations that follow, annual dividends will be defined as the total dividends distributed by any given REIT in their financial year, not the calendar year. Special dividends, if any, will be included in the computation of dividend growth. Data will be taken from the most recent annual report. Current dividend yield will be taken from the REIT Data site at the time of this blog post (30 October 2018).

With d referring to total dividends distributed in the financial year and y referring to the current year, let 5-year dividend growth rate be:

((dy - dy-1)/dy-1+(dy-1 - dy-2)/dy-2+(dy-2 - dy-3)/dy-3+(dy-3 - dy-4)/dy-4+(dy-4 - dy-5)/dy-5)/5

I won't be calculating the Chowder Rule for all the REITs; I will only be looking at a select few REITs.

AIMS AMP Capital Industrial REIT

5-year dividend growth rate: -1.12%

Current dividend yield: 7.741%

Chowder Rule value: 6.62%

Ascendas REIT

5-year dividend growth rate: 3.08%

Current dividend yield: 6.272%

Chowder Rule value: 9.35%

Capitaland Commercial Trust

5-year dividend growth rate: 1.56%

Current dividend yield: 4.767%

Chowder Rule value: 6.33%

Capitaland Mall Trust

5-year dividend growth rate: 3.42%

Current dividend yield: 5.264%

Chowder Rule value: 8.68%

First REIT

5-year dividend growth rate: 3.39%

Current dividend yield: 7.142%

Chowder Rule value: 10.53%

Frasers Centrepoint Trust

5-year dividend growth rate: 3.56%

Current dividend yield: 5.586%

Chowder Rule value: 9.15%

Keppel REIT

5-year dividend growth rate: -5.92%

Current dividend yield: 5.062%

Chowder Rule value: -0.86%

Lippo Mall Trust

5-year dividend growth rate: 3.66%

Current dividend yield: 14.044%

Chowder Rule value: 17.70%

Mapletree Commercial Trust

5-year dividend growth rate: 6.94%

Current dividend yield: 5.644%

Chowder Rule value: 12.58%

Mapletree Industrial Trust

5-year dividend growth rate: 4.94%

Current dividend yield: 6.194%

Chowder Rule value: 11.13%

Mapletree Logistics Trust

5-year dividend growth rate: 2.16%

Current dividend yield: 6.252%

Chowder Rule value: 8.41%

Parkway Life REIT

5-year dividend growth rate: 5.63%

Current dividend yield: 4.773%

Chowder Rule value: 10.40%

Sabana REIT

5-year dividend growth rate: -17.65%

Current dividend yield: 8.329%

Chowder Rule value: -9.32%

Starhill Global REIT

5-year dividend growth rate: 0.99%

Current dividend yield: 6.977%

Chowder Rule value: 7.97%

Make what you will of these figures. Have fun!

Wednesday, October 10, 2018

Q3 2018 Portfolio Update

Another quarter has passed and it is time to review my portfolio again.

Dividend Income

Dividends received from my SGD-denominated portfolio in Q3 2018 fell, when compared to the same quarter last year. This trend has persisted for quite some time and it is symptomatic of deeper issues that my portfolio is somehow not quite right. Shouldn't an income investor receive more dividends through the passage of time? With some psychic pain, I persisted in my task of pruning the fundamentally weaker stocks from my portfolio. The drops in dividends received should stabilize in another quarter or two.

On the other hand, the dividends received from my USD-denominated portfolio is growing steadily, a result from both capital injections into dividend growth stocks and dividend growth from said counters.

Transactions

In this quarter, I initiated a new and small entry into OCBC when its price fell from its peak. With this move, my portfolio has some exposure to the financial sector again (after divesting iFAST, Hong Leong Finance, and T Rowe Price previously).

I exited my entire position in Lippo Mall Trust and Accordia Golf Trust in this quarter. Previously, I have taken partial profits for these two counters when they were at their highs. This time round, I exited the remaining stake for both at below my cost price. Overall, these two trades turned out profitable.

An investment blogger friend sounded out to me that there were some flaws in my thinking and I am grateful for that. Specifically, what I intended to do with regards to Lippo Mall Trust was to shrug off any unrealized losses as I got them at a (formerly) very low price of $0.30. Since I have taken partial profits at $0.40 and have received almost 3 years' worth of dividends, I was willing to hold it through a market crash coupled with its deteriorating fundamentals. I was even contemplating to buy more in a market crash. Somehow, the following thought eluded me: some counters go down..........and stay down. Okay, now I know better. Thanks friend!

As for Accordia Golf Trust, the dividend trend is not looking good.

As for Accordia Golf Trust, the dividend trend is not looking good.

I added to my position in Hongkong Land. Nothing much to be added here; I like the recurring income from their investment properties and their clean balance sheet. To quote a friend who aptly described my position, I am treating Hongkong land as an un-levered REIT income play.

I also added to my position in JM Smucker. Despite the challenges faced, JM Smucker is still going strong (relative to its consumer staples peers). Looking to scale in further if opportunities present itself.

Net worth breakdown

There has been minimal changes to my net worth breakdown when compared to the previous quarter.

As per before, "the pie chart depicts the breakdown in my net worth across the various asset classes in percentage (pie chart neither includes my CPF nor my emergency fund). To be conservative, I computed my precious metals allocation at spot price even though I am holding everything in physicals."

Emergency Fund

On the ground, things don't really look good. Based on anecdotal evidence, I have heard of contracts not getting renewed and retrenchment exercises taking place.

At my end, I have continued to build up our emergency fund each month. I mentally segregate the emergency fund from investable cash. That way, in a real market crash cum recession, my mind will be free to operate in a cold and clinical fashion.

Strategy moving forward

In the interim, I am exposing myself to opportunities in other markets.

I have created a trading account to trade Hong Kong stocks and another trading account to trade Singapore stocks (in the event that my main Singapore trading account fails when everyone is trying to exit their positions in a market crash).

I will be creating a Malaysia trading account and a Denmark trading account soon.......after I am done with reading up on the rules and regulations.

If this is the calm before the storm, I appreciate all the time I can get to research stocks, re-confirm my choices, build up my emergency fund and my cash levels.

As per before, "the pie chart depicts the breakdown in my net worth across the various asset classes in percentage (pie chart neither includes my CPF nor my emergency fund). To be conservative, I computed my precious metals allocation at spot price even though I am holding everything in physicals."

Emergency Fund

On the ground, things don't really look good. Based on anecdotal evidence, I have heard of contracts not getting renewed and retrenchment exercises taking place.

At my end, I have continued to build up our emergency fund each month. I mentally segregate the emergency fund from investable cash. That way, in a real market crash cum recession, my mind will be free to operate in a cold and clinical fashion.

Strategy moving forward

In the interim, I am exposing myself to opportunities in other markets.

I have created a trading account to trade Hong Kong stocks and another trading account to trade Singapore stocks (in the event that my main Singapore trading account fails when everyone is trying to exit their positions in a market crash).

I will be creating a Malaysia trading account and a Denmark trading account soon.......after I am done with reading up on the rules and regulations.

If this is the calm before the storm, I appreciate all the time I can get to research stocks, re-confirm my choices, build up my emergency fund and my cash levels.

Tuesday, September 11, 2018

The growth of NextEra Energy and Florida population growth

In one of my previous post, I triangulated the growth of Consolidated Edison with New York City, the city that it predominantly serves.

In this post, I will be adopting the same approach in my evaluation of NextEra Energy (NEE), another utility company that I have come across while prospecting for investment opportunities.

NEE might be an unfamiliar name to readers. To help readers get acquainted with the company, I shall lift the following paragraph from their 2017 annual report, "NEE is one of the largest electric power and energy infrastructure companies in North America and a leader in the renewable energy industry. NEE has two principal businesses, Florida Power & Light (FPL) and NextEra Energy Resources (NEER). FPL is the largest electric utility in the state of Florida and one of the largest electric utilities in the U.S. FPL's strategic focus is centered on investing in generation, transmission and distribution facilities to continue to deliver on its value proposition of low bills, high reliability, outstanding customer service and clean energy solutions for the benefit of its nearly five million customers. NEER is the world's largest operator of wind and solar projects. NEER's strategic focus is centered on the development, construction and operation of long-term contracted assets throughout the U.S. and Canada, including renewable generation facilities, natural gas pipelines and battery storage projects."

My focus today is not on the firm as a whole. Instead, I will be delving into FPL only. As of 31 December 2017, FPL had approximately 26,600 MW of net generating capacity, approximately 75,000 circuit miles of transmission and distribution lines and approximately 620 substations. FPL provides service to its customers through an integrated transmission and distribution system that links its generation facilities to its customers. They serve approximately ten million people through nearly five million customer accounts. Their service territory covers most of the east and lower west coasts of Florida (see image below).

FPL's primary source of operating revenues comes from its retail customer base (see below).

Similar to what I have shared in my article on Consolidated Edison, there is a limit to the price hikes a utility company could charge. Further growth, like what I have suggested in my previous article, could come from a growth in the Florida population, which the firm operates in.

Let us take a look at Florida's population growth trend by considering data from the Office of Economic & Demographic Research (EDR). Similar to New York City, a census is conducted once every 10 years, with the most recent one being in 2010.

At the state level, the Florida population grew from 15,982,824 to 18,801,310 from year 2000 to 2010. This is an increase of 17.6%. In the "Florida Estimates of Population 2017" report, the population was estimated to be at 20,484,142 at April 2017. This is an increase of 8.9% over the period of 7 years. Population growth has slowed down.

However, current estimates have to be revised downwards. According to the executive summary of the Demographic Estimating Conference held on 9 July 2018, the change in population was magnified due to the effects of Hurricane Maria. To flee the hurricane, people moved from Puerto Rico to Florida. For some, they eventually settled into Florida permanently. This adds another layer of perspective to my understanding of how natural disasters impact human migration and, in turn, impact the companies that operate in the particular region.

The EDR website has plenty of data visualizations that would help us better understand the Florida population. I will be highlighting a few of them here.

The following image illustrates the total population of Florida by its counties in year 2010. If you mentally superimpose the following map on the above map, you will observe that NEE serves counties that are highlighted in green, blue, and red in the map below. These are counties that contain a larger population size in relation to the total population of Florida. Miami-Dade and Broward counties are the two most populous and NEE is serving them (in 2010, at least).

The following map shows a different look at the same data. It considers the population density of each county. Similarly, it paints NEE in a good light; the more population-dense counties were served by NEE when you superimposed the below map with the first map above (for year 2010, at least). Furthermore, quite a few of the counties are reflected in yellow and green. If there is a positive net migration, these counties could still accommodate additional numbers.

The maps also reveal that NEE has no presence in Duval, Hillsborough, and Pinellas counties. These 3 counties are reflected in blue in the second map (Total Population by County: 2010) and 2 blues and 1 red in the third map (Population Density by County: 2010), respectively.

Next, let us take a look at the population growth components. The following graph is taken from the "Demographic Overview & Population Trends" presentation, dated 6 November 2013.

Most of the growth in the Florida population could be attributed to net migration instead of a natural increase. Though it was not specified, I infer that natural increase refers to net birth rates - death rates.

In the same presentation slides, we are also informed that Florida has an aging population (see below).

Hold on to those thoughts.

In various articles, Florida occupies one of the top few spots for retirement (see here, here, and here). It is plausible that Florida's population growth could see further growth as a retirement destination; the growth components, population by age group, and retirement destination trends support it. Furthermore, it overtook New York and became the third most populous state in the US (see here and here). NextEra Energy seems poised to benefit from these trends.

Not vested in NextEra Energy. NextEra Energy is in my watchlist.

Let us take a look at Florida's population growth trend by considering data from the Office of Economic & Demographic Research (EDR). Similar to New York City, a census is conducted once every 10 years, with the most recent one being in 2010.

At the state level, the Florida population grew from 15,982,824 to 18,801,310 from year 2000 to 2010. This is an increase of 17.6%. In the "Florida Estimates of Population 2017" report, the population was estimated to be at 20,484,142 at April 2017. This is an increase of 8.9% over the period of 7 years. Population growth has slowed down.

However, current estimates have to be revised downwards. According to the executive summary of the Demographic Estimating Conference held on 9 July 2018, the change in population was magnified due to the effects of Hurricane Maria. To flee the hurricane, people moved from Puerto Rico to Florida. For some, they eventually settled into Florida permanently. This adds another layer of perspective to my understanding of how natural disasters impact human migration and, in turn, impact the companies that operate in the particular region.

The EDR website has plenty of data visualizations that would help us better understand the Florida population. I will be highlighting a few of them here.

The following image illustrates the total population of Florida by its counties in year 2010. If you mentally superimpose the following map on the above map, you will observe that NEE serves counties that are highlighted in green, blue, and red in the map below. These are counties that contain a larger population size in relation to the total population of Florida. Miami-Dade and Broward counties are the two most populous and NEE is serving them (in 2010, at least).

The following map shows a different look at the same data. It considers the population density of each county. Similarly, it paints NEE in a good light; the more population-dense counties were served by NEE when you superimposed the below map with the first map above (for year 2010, at least). Furthermore, quite a few of the counties are reflected in yellow and green. If there is a positive net migration, these counties could still accommodate additional numbers.

The maps also reveal that NEE has no presence in Duval, Hillsborough, and Pinellas counties. These 3 counties are reflected in blue in the second map (Total Population by County: 2010) and 2 blues and 1 red in the third map (Population Density by County: 2010), respectively.

Next, let us take a look at the population growth components. The following graph is taken from the "Demographic Overview & Population Trends" presentation, dated 6 November 2013.

Most of the growth in the Florida population could be attributed to net migration instead of a natural increase. Though it was not specified, I infer that natural increase refers to net birth rates - death rates.

In the same presentation slides, we are also informed that Florida has an aging population (see below).

Hold on to those thoughts.

In various articles, Florida occupies one of the top few spots for retirement (see here, here, and here). It is plausible that Florida's population growth could see further growth as a retirement destination; the growth components, population by age group, and retirement destination trends support it. Furthermore, it overtook New York and became the third most populous state in the US (see here and here). NextEra Energy seems poised to benefit from these trends.

Not vested in NextEra Energy. NextEra Energy is in my watchlist.

Friday, August 17, 2018

To Sleepydevil: Making good use of your time in NS

This post is dedicated to Sleepydevil, who is enlisting soon.

During this period, you may find it more comfortable to follow the herd and allow your mind to stagnate. In this piece, I hope to encourage you to focus on maintaining or, even better still, to improve and allow your mind to flourish.

There will be pockets of free time here and there. There will be weekends for you to pursue your interests. The point is to incorporate bits and pieces of self-improvement into these pockets of free time. Push yourself a little each day and, over the 2 years, your hard work will surely compound. The key is moderation, so that you will develop into a well-rounded person. I am sure this is not new to you, so let me share a few examples to get you all fired up.

I have a friend in army. Let us call him "A." "A" is from Raffles JC with very good 'A' level grades. One critique that is often leveled against the JC system by poly students is that JC students do not have advanced standing which they could use in the university level. Not for "A" though. During his 2 years of NS, he signed up for a University of London diploma programme. With this, he effectively had both good 'A' level grades and a diploma (which confers advanced standing) to boot.

After NS, he only had 2 more years of education to go before he got his degree. He flew to LSE and completed his degree. Today, he is rising up the ranks in the corporate world (based on what I found on his LinkedIn page).

Next, we have yours truly Unintelligent Nerd. For context, I am a Polytechnic student. During my 2 years of NS, I accumulated plenty of module credits for a particular post-graduate programme in humanities which I was interested in. At the same year I got my degree, I got my graduate diploma as well (the prerequisite for graduation is that I have to have a degree first). With the benefit of hindsight, while I did make good use of my time in NS, my prioritization was way off the mark. Studying for interest should not come before studying for practical reasons such as earning a living.

When I went for the graduation ceremony for my graduate diploma in humanities, I came to know one other chap who did the same thing. Let us call him "B." Similar to myself, he took up the programme for personal interest. This is where the similarity ends. He majored in law, a profession that could well support any of his interests. Based on a search of his LinkedIn page, he is currently upgrading his graduate diploma in humanities to a masters in humanities.

I do not directly know the next person in my sharing. According to one of my friends who spams specialist diplomas in the local polytechnics, he had the pleasure of getting to know a polytechnic graduate who took a specialist diploma while still serving NS. While in polytechnic, this young fellow already had good grades. The specialist diploma, along with some personal projects he is involved in, is the icing on the cake.

Not all tales end happily ever after right? Finally, there was another guy I know from camp who commenced on his studies. Halfway through his studies, he was posted out to another unit. There, he had less flexible superiors who disallowed him to continue his studies.

I hope these examples will motivate and encourage you. I know that they revolve around getting a certificate from a brick-and-mortar educational institute. Focus not on the examples, but on the underlying principles of personal agency and self-improvement.

Also, know who and when to ask for permission. There is a season for everything. Asking when the stars are aligned yields a more favourable outcome.

Hope this helps!

Cheers

During this period, you may find it more comfortable to follow the herd and allow your mind to stagnate. In this piece, I hope to encourage you to focus on maintaining or, even better still, to improve and allow your mind to flourish.

There will be pockets of free time here and there. There will be weekends for you to pursue your interests. The point is to incorporate bits and pieces of self-improvement into these pockets of free time. Push yourself a little each day and, over the 2 years, your hard work will surely compound. The key is moderation, so that you will develop into a well-rounded person. I am sure this is not new to you, so let me share a few examples to get you all fired up.

I have a friend in army. Let us call him "A." "A" is from Raffles JC with very good 'A' level grades. One critique that is often leveled against the JC system by poly students is that JC students do not have advanced standing which they could use in the university level. Not for "A" though. During his 2 years of NS, he signed up for a University of London diploma programme. With this, he effectively had both good 'A' level grades and a diploma (which confers advanced standing) to boot.

After NS, he only had 2 more years of education to go before he got his degree. He flew to LSE and completed his degree. Today, he is rising up the ranks in the corporate world (based on what I found on his LinkedIn page).

Next, we have yours truly Unintelligent Nerd. For context, I am a Polytechnic student. During my 2 years of NS, I accumulated plenty of module credits for a particular post-graduate programme in humanities which I was interested in. At the same year I got my degree, I got my graduate diploma as well (the prerequisite for graduation is that I have to have a degree first). With the benefit of hindsight, while I did make good use of my time in NS, my prioritization was way off the mark. Studying for interest should not come before studying for practical reasons such as earning a living.

When I went for the graduation ceremony for my graduate diploma in humanities, I came to know one other chap who did the same thing. Let us call him "B." Similar to myself, he took up the programme for personal interest. This is where the similarity ends. He majored in law, a profession that could well support any of his interests. Based on a search of his LinkedIn page, he is currently upgrading his graduate diploma in humanities to a masters in humanities.

I do not directly know the next person in my sharing. According to one of my friends who spams specialist diplomas in the local polytechnics, he had the pleasure of getting to know a polytechnic graduate who took a specialist diploma while still serving NS. While in polytechnic, this young fellow already had good grades. The specialist diploma, along with some personal projects he is involved in, is the icing on the cake.

Not all tales end happily ever after right? Finally, there was another guy I know from camp who commenced on his studies. Halfway through his studies, he was posted out to another unit. There, he had less flexible superiors who disallowed him to continue his studies.

I hope these examples will motivate and encourage you. I know that they revolve around getting a certificate from a brick-and-mortar educational institute. Focus not on the examples, but on the underlying principles of personal agency and self-improvement.

Also, know who and when to ask for permission. There is a season for everything. Asking when the stars are aligned yields a more favourable outcome.

Hope this helps!

Cheers

Wednesday, August 1, 2018

The growth of Consolidated Edison and New York City population growth

I have a personal preference for stocks with recurring cash flows. Hence, my equity holdings comprise largely of REITs and consumer staples. Recently, I have been reading up on utility stocks, which is another sector known for stable, recurring cash flows.

In the US dividend aristocrat list, there is only one utility company on the list that has stood the test of time: Consolidated Edison

Consolidated Edison is a provider of electric, gas, and steam. According to their 2017 Annual Report, they are a holding company that owns:

In the US dividend aristocrat list, there is only one utility company on the list that has stood the test of time: Consolidated Edison

Consolidated Edison is a provider of electric, gas, and steam. According to their 2017 Annual Report, they are a holding company that owns:

- Consolidated Edison Company of New York, Inc. (CECONY), which delivers electricity, natural gas and steam to customers in New York City and Westchester County;

- Orange & Rockland Utilities, Inc. (O&R), which together with its subsidiary, Rockland Electric Company, delivers electricity and natural gas to customers primarily located in southeastern New York State and northern New Jersey (O&R, together with CECONY referred to as the Utilities);

- Con Edison Clean Energy Businesses, Inc., which through its subsidiaries develops, owns and operates renewable and energy infrastructure projects and provides energy-related products and services to wholesale and retail customers (Con Edison Clean Energy Businesses, Inc., together with its subsidiaries referred to as the Clean Energy Businesses); and

- Con Edison Transmission, Inc., which through its subsidiaries invests in electric and gas transmission projects (Con Edison Transmission, Inc., together with its subsidiaries referred to as Con Edison Transmission).

The same information could be visually represented as follows (taken from their Q1 2018 Earnings Presentation):

A huge chunk of the revenue and earnings for Consolidated Edison comes from its utility business. The screenshot below (taken from their 2017 Annual Report) shows that 94% of revenue and 76% of earnings is contributed by the utility business. Once we remove the revenue and earnings contribution from their O&R utility business, we can see that CECONY contributes a whooping 87% and 72% to revenue and earnings, respectively.

Hence, investors in Consolidated Edison have to be attentive to the changes in New York City and Westchester County, where CECONY operates.

In order for Consolidated Edison to continue growing its dividend (as of 2018, they have an annual dividend growth streak of 44 years!), prices for its services has to continue growing. However, there is a limit to raising utility prices. Another way that the company could grow is to see a growth in its consumer base in New York City and Westchester County.

How has the population growth in New York City been?

Let us turn to the New York City Department of City Planning website for further info. I would like to highlight a few salient points that I have gleaned from exploring their website.

First up is the Decennial Census data. A census is conducted once every ten years, with the two most recent ones done in 2000 and 2010. 2010 is a long time back, so care has to be taken when making inferences from the data.

The data shows that population growth in New York City grew by 2.1% from 2000 to 2010. When population growth is segmented by race, another picture emerges. The Asian and Pacific Islander Nonhispanic group grew a whooping 31.7% while the other groups show small declines (the other exception is the Hispanic Origin group which grew by 8.1% over the same period).

Asians are a very diverse category. In another report, a breakdown of the various Asian subgroups are provided. Of the subgroups, the Chinese is most heavily represented (6% of entire population) in 2010.

The above data is pretty dated. Let us turn to more recent data by reviewing the Current and Projected Populations page.

The Current and Projected Populations page estimates that the New York City population increased by 5.5% from April 2010 to July 2017. Compared to the 2000 to 2010 decade, this is an improvement. We also learn that population growth is fueled by a surplus of births over deaths due to improved life expectancy, which has been partially offset by net outflows from the city.

The details are unpacked in the report "Info Brief: Migration to and from NYC report" (dated August 2017). According to the report, population change is captured in two ways: (a) through migration, and (b) natural increase (births minus deaths).

When migration flow is segmented by race, we see that the Asian, nonhispanic group has demonstrated consistent net inflows. In more recent times, net outflow of the White, nonhispanic group has transformed into net inflow.

When the data is segmented by age, we learn that New York City consistently attracts people in their 20s across the years. In all other age groups, there is a net outflow, with the outflow slowing in recent years.

For people who have worked 50 weeks or more the preceding year, there has been a net inflow of migrants of all income categories in recent years.

The report concluded that "throughout the last 40 years, migrants have been disproportionately young adults, unmarried, and holding high-skilled jobs (not illustrated in this Brief), reflecting that these groups often have more flexibility and resources to move." They added that "age is one of the best predictors of migration. NYC consistently attracts large number of people in their 20s, and generally sees net migration losses of people in all other age groups. This is tied to a common pattern whereby young single people move to the City, and some residents move out after family formation."

There were also some statements that were made in reference to the GFC: "Following the 2009 recession, NYC has captured a large portion of the region's job growth, which is reflected in worker migration. For the first time since 1975, NYC now has net migration gains of workers in all earnings groups, particularly in the $25k to $49k range. Current data shows historically high net migration gains for workers making $75k and over. Higher earners are coming to the City in larger numbers than previously and are likelier to stay."

When you triangulate the data sources above, one could reasonably infer that the Chinese inflow has been contributing to the population growth in New York City. At a broad level, highly-mobile and highly-skilled workers have come to New York City to make their fortunes, have a better standard of living, etc. In my opinion, it is a tad bit optimistic to infer that these same qualified individuals might be settling down in New York City for the long term; we should also consider the alternative that they are free to reside wherever they want. As long as New York City remains a viable destination for people to make their fortunes, have a better standard of living, etc., the city could see further population growth. The trend documented above lends some support to this conclusion. If this pans out, we will see Consolidated Edison growing its user base, which would then be supportive of their dividend growth.

Let us turn to the New York City Department of City Planning website for further info. I would like to highlight a few salient points that I have gleaned from exploring their website.

First up is the Decennial Census data. A census is conducted once every ten years, with the two most recent ones done in 2000 and 2010. 2010 is a long time back, so care has to be taken when making inferences from the data.

The data shows that population growth in New York City grew by 2.1% from 2000 to 2010. When population growth is segmented by race, another picture emerges. The Asian and Pacific Islander Nonhispanic group grew a whooping 31.7% while the other groups show small declines (the other exception is the Hispanic Origin group which grew by 8.1% over the same period).

Asians are a very diverse category. In another report, a breakdown of the various Asian subgroups are provided. Of the subgroups, the Chinese is most heavily represented (6% of entire population) in 2010.

The above data is pretty dated. Let us turn to more recent data by reviewing the Current and Projected Populations page.

The Current and Projected Populations page estimates that the New York City population increased by 5.5% from April 2010 to July 2017. Compared to the 2000 to 2010 decade, this is an improvement. We also learn that population growth is fueled by a surplus of births over deaths due to improved life expectancy, which has been partially offset by net outflows from the city.

The details are unpacked in the report "Info Brief: Migration to and from NYC report" (dated August 2017). According to the report, population change is captured in two ways: (a) through migration, and (b) natural increase (births minus deaths).

When migration flow is segmented by race, we see that the Asian, nonhispanic group has demonstrated consistent net inflows. In more recent times, net outflow of the White, nonhispanic group has transformed into net inflow.

When the data is segmented by age, we learn that New York City consistently attracts people in their 20s across the years. In all other age groups, there is a net outflow, with the outflow slowing in recent years.

For people who have worked 50 weeks or more the preceding year, there has been a net inflow of migrants of all income categories in recent years.

The report concluded that "throughout the last 40 years, migrants have been disproportionately young adults, unmarried, and holding high-skilled jobs (not illustrated in this Brief), reflecting that these groups often have more flexibility and resources to move." They added that "age is one of the best predictors of migration. NYC consistently attracts large number of people in their 20s, and generally sees net migration losses of people in all other age groups. This is tied to a common pattern whereby young single people move to the City, and some residents move out after family formation."

There were also some statements that were made in reference to the GFC: "Following the 2009 recession, NYC has captured a large portion of the region's job growth, which is reflected in worker migration. For the first time since 1975, NYC now has net migration gains of workers in all earnings groups, particularly in the $25k to $49k range. Current data shows historically high net migration gains for workers making $75k and over. Higher earners are coming to the City in larger numbers than previously and are likelier to stay."

When you triangulate the data sources above, one could reasonably infer that the Chinese inflow has been contributing to the population growth in New York City. At a broad level, highly-mobile and highly-skilled workers have come to New York City to make their fortunes, have a better standard of living, etc. In my opinion, it is a tad bit optimistic to infer that these same qualified individuals might be settling down in New York City for the long term; we should also consider the alternative that they are free to reside wherever they want. As long as New York City remains a viable destination for people to make their fortunes, have a better standard of living, etc., the city could see further population growth. The trend documented above lends some support to this conclusion. If this pans out, we will see Consolidated Edison growing its user base, which would then be supportive of their dividend growth.

Friday, July 20, 2018

Q2 2018 Portfolio Update

Time flies. I didn't even realize that Q2 2018 is over; I must have been too engrossed with reading, prospecting stocks, and gaming lately. =P

Dividend Income

Dividends received from my SGD-denominated portfolio in Q2 2018 fell, when compared to the same quarter last year. This could be attributed to weaker performance from my less-fundamentally strong yield stocks and plenty of divestments I have made in earlier periods.

In retrospect, it seemed like a good decision to take profits when people were starting to bid up the price of yield stocks, including the weaker ones. It made me realize that when a decision has to be made between two "fairly comparable" counters, I would be more inclined to take the lower yielding one. The higher yielding one, based on what I have experienced thus far, tends to disappoint. The slight increase in yield is ephemeral. The juice may not be worth the squeeze.

Transactions

In this quarter, I scaled in further into Thai Beverage when the price dropped to a level which I have previously determined that I will scale in to. This is part of my risk management strategy where I position size my counters in such a way that, even after scaling in, that particular counter would not take up an inordinate amount of weight in my overall net worth. As it is, said risk management strategy is still provisional and I am still tweaking it as I go along. Since then, the price of Thai Beverage has fallen even further, but it has yet to hit my second scale-in price, so I am not going to do anything about it. The same goes for Singtel which has seen its share price beaten down recently.

I did quite a bit of pruning on my equity positions this quarter. I divested my entire stakes in Starhill Global REIT, Neratel, and Kingsmen Creatives. Starhill Global REIT's performance has been average thus far and the funds could be better allocated elsewhere. After including dividends and taking into account transaction costs, I made a small loss in Starhill Global REIT.

After the sale of its payment solutions business to Ingenico Group, I actually had no reason to hold Neratel for its dividends anymore. Still, I engaged in mental gymnastics, telling myself that ooonnneeee day, I will go and read up and familiarize myself with its other businesses. Well, I don't think that day will come and, besides, my limited mental energy could be better spent on analyzing areas that I am more familiar with that has more ROI. It's not just capital allocation only; as a white-collar worker, what mental energy remains after office hours needs to be strongly guarded and judiciously allocated towards appropriate channels.

I digress. Anyway, I sold my Neratel at a loss. On the first day, only 100 shares were filled. On the second day, all except the remaining 100 shares were filled. On the third day, the remaining 100 shares were filled. For those who are into illiquid shares, stuff like this may happen, so be prepared.

I divested Kingsmen Creatives at a loss for the following reasons: (a) they have been under-performing, (2) I need to exert even more effort to read up on their businesses (when that effort could be better spent elsewhere), and (3) the funds could be better spent elsewhere.

In this quarter, I averaged up my position in Parkway Life REIT when its price corrected from its recent high. Post-purchase, my position size in Parkway Life REIT is still kept at manageable levels.

Let me digress once more. There is this tendency to view healthcare-related counters as defensive. In our local context, this adage seems to hold true for counters such as Parkway Life REIT and First REIT. However, my experience with US healthcare REITs are a different story altogether. A couple of months back, the US healthcare REITs sector was hit by a triple whammy of rising interest rates, change in healthcare policies regarding long-term care payment, and the flu epidemic. US healthcare REITs that predominantly served the long-term care population were hit the hardest as fewer people wanted to stay in nursing homes and people who were staying in nursing homes wanted to get out owing to the increased probability of flu spreading from one patient to the next in close proximity.

SG-listed healthcare REITs are a bit........too peaceful? I admit that they are doing good, but my risk management system demands that I do not fall in love in them. Curve balls do come; it is not a matter of if but of when. Hence, they should not be granted exceptions in matters pertaining to position sizing.

I initiated a new position in Mapletree Commercial Trust when the price corrected in this quarter. It is a small position which I intend to build upon further during the next rights issue.

Finally, I added to gold and silver multiple times during this quarter. I wasted money on a graded gold coin I have been eyeing for a long time (there goes a chunk of my bonus.......) and a 2nd hand antique silver bar that was up for sale a couple of days ago.

Portfolio Overview and Capital Allocation thoughts

Both my SGD-denominated and my USD-denominated are in the green with small pockets of red from counters like Singtel, Thai Beverage, and QAF which has gone to the gutters.

My equity allocation still consists predominantly of REITs, reflecting my preference for an income-oriented strategy. It is complemented with property developers, consumer staples and healthcare stocks and a catch-all "others" category. The following lists are not arranged in position size.

REITs/Business Trusts:

AIMSAMP REIT, Frasers Centrepoint Trust, First REIT, Lippo Malls, Accordia Golf Trust, Parkway Life REIT, SPH REIT, Mapletree Industrial Trust, Mapletree Commercial Trust, Capitaland Mall Trust, Frasers Commercial Trust, Welltower REIT

Property Developers:

Hongkong Land, Frasers Property

Consumer Staples:

Dairy Farm, Sheng Siong, Thai Beverage, Yeo Hiap Seng, QAF, Kimberly Clark, JM Smucker, Hormel Foods, General Mills

Healthcare:

Raffles Medical Group, Abbott Laboratories, ISEC

Others:

Japan Foods Holding, ST Engineering, SGX, Singtel, SATS

I have the intention of transforming my equity allocation into a 5-sector portfolio consisting of REITs, consumer staples, healthcare, utilities, and a catch-all others category. As the US consumer staples and utilities sector rebounded lately, I've totally missed out on the action. If you are wondering, the valuation was just merely "fair"; it was not a screaming buy or anything like that.

I foresee the names in the above lists to shrink even further. Some of them have been found wanting for having a poor record.

There are some questionable names in the above lists as well. As I've managed to catch them at their lows, collect multiple rounds of dividends, and take partial profits when they went up, I am quite comfortable holding on to them still, even though their fundamentals are.......questionable. In the event of a rights issue for these questionable cases, I've already planned to either sell off the rights or to subscribe to my allotted rights. For such cases, excess rights are not for me!

In the interim, I am prospecting stocks. From a financials perspective, my Singapore and US watch list has, more or less, been firmed up. The next step is to dig deeper into their annual reports and familiarize myself with their business prospects.

Net worth breakdown

As per before, "the pie chart depicts the breakdown in my net worth across the various asset classes in percentage (pie chart neither includes my CPF nor my emergency fund). To be conservative, I computed my precious metals allocation at spot price even though I am holding everything in physicals."

CAPEX

After falling sick quite often and experiencing some form of burnt-out, I dropped out of my 3rd specialist diploma halfway (as detailed in my Q1 2018 post). Since then, I have been enjoying my free time first by casual reading, followed by prospecting stocks, and then by gaming.

Now that I am much more refreshed, it is time to engage in some personal CAPEX again. I have identified University of London's Graduate Diploma in Data Science (by distance learning) as my next education target and will be applying for it soon. The fees are quite economical (SGD $3800 for the entire programme) and the programme is rigorous, so that's good.

I signed up as a NTUC member last year in order to make use of the Union Training Assistance Programme (UTAP). Members enjoy course fee support for up to $250 each year when you sign up for courses supported under UTAP. Well, half of 2018 has gone by and I've yet to make use of UTAP. I've identified a few courses and will be applying and going for them shortly.

There will be some law certification programme that will be held at my workplace. I know it has no link with my current job scope but I went ahead anyway asking my bosses for their blessings. I wanted to acquire practical skills that could help me to be a better investor, but it was not meant to be in this calendar year. After all, they will be sending me to a tech course before the close of this calendar year.

Health

The above is not possible without sustained good health. The results from my annual health checkup concluded that my health is okay, with needed improvements in my total cholesterol levels and LDL cholesterol ("bad cholesterol") levels. I realized that I have been consuming more meat in my diet to cope with stress. I will be more conscious of my reaction to stressors from now on and to incorporate more exercise to my life.

Emergency Fund

I intend to add more to our shared emergency fund. In fact, I topped up our emergency fund with a portion of my bonus. I find that increasing the absolute value of our emergency fund gives me a greater peace of mind, especially in uncertain economic times. Unfortunately, my desktop computer of 9 years died last weekend and my mum wanted to use our emergency fund to fund the new purchase (I know buying a new computer does not constitute an emergency! lol)

Gaming

Some people have been curious with what games have I been playing recently. I normally play games by independent developers (e.g. "indie games") as they have more varied premises, with varied meaning downright weird or interesting depending on how you look at it.

As my words will not do them any justice, I shall let the following youtube videos to do the talking:

Enter the Gungeon

Dividend Income

Dividends received from my SGD-denominated portfolio in Q2 2018 fell, when compared to the same quarter last year. This could be attributed to weaker performance from my less-fundamentally strong yield stocks and plenty of divestments I have made in earlier periods.

In retrospect, it seemed like a good decision to take profits when people were starting to bid up the price of yield stocks, including the weaker ones. It made me realize that when a decision has to be made between two "fairly comparable" counters, I would be more inclined to take the lower yielding one. The higher yielding one, based on what I have experienced thus far, tends to disappoint. The slight increase in yield is ephemeral. The juice may not be worth the squeeze.

Q2 2018 dividend income from my USD-denominated portfolio broke the record for all-time high! In absolute dollars-terms, it is still pretty meh (look at the y-axis). The increase is mainly due to capital injections last year, which has finally taken effect now. As my positions are still minuscule, I can't really discern the "dividend growth" in my supposedly "dividend growth USD-denominated portfolio."

Transactions

In this quarter, I scaled in further into Thai Beverage when the price dropped to a level which I have previously determined that I will scale in to. This is part of my risk management strategy where I position size my counters in such a way that, even after scaling in, that particular counter would not take up an inordinate amount of weight in my overall net worth. As it is, said risk management strategy is still provisional and I am still tweaking it as I go along. Since then, the price of Thai Beverage has fallen even further, but it has yet to hit my second scale-in price, so I am not going to do anything about it. The same goes for Singtel which has seen its share price beaten down recently.

I did quite a bit of pruning on my equity positions this quarter. I divested my entire stakes in Starhill Global REIT, Neratel, and Kingsmen Creatives. Starhill Global REIT's performance has been average thus far and the funds could be better allocated elsewhere. After including dividends and taking into account transaction costs, I made a small loss in Starhill Global REIT.

After the sale of its payment solutions business to Ingenico Group, I actually had no reason to hold Neratel for its dividends anymore. Still, I engaged in mental gymnastics, telling myself that ooonnneeee day, I will go and read up and familiarize myself with its other businesses. Well, I don't think that day will come and, besides, my limited mental energy could be better spent on analyzing areas that I am more familiar with that has more ROI. It's not just capital allocation only; as a white-collar worker, what mental energy remains after office hours needs to be strongly guarded and judiciously allocated towards appropriate channels.

I digress. Anyway, I sold my Neratel at a loss. On the first day, only 100 shares were filled. On the second day, all except the remaining 100 shares were filled. On the third day, the remaining 100 shares were filled. For those who are into illiquid shares, stuff like this may happen, so be prepared.

I divested Kingsmen Creatives at a loss for the following reasons: (a) they have been under-performing, (2) I need to exert even more effort to read up on their businesses (when that effort could be better spent elsewhere), and (3) the funds could be better spent elsewhere.

In this quarter, I averaged up my position in Parkway Life REIT when its price corrected from its recent high. Post-purchase, my position size in Parkway Life REIT is still kept at manageable levels.

Let me digress once more. There is this tendency to view healthcare-related counters as defensive. In our local context, this adage seems to hold true for counters such as Parkway Life REIT and First REIT. However, my experience with US healthcare REITs are a different story altogether. A couple of months back, the US healthcare REITs sector was hit by a triple whammy of rising interest rates, change in healthcare policies regarding long-term care payment, and the flu epidemic. US healthcare REITs that predominantly served the long-term care population were hit the hardest as fewer people wanted to stay in nursing homes and people who were staying in nursing homes wanted to get out owing to the increased probability of flu spreading from one patient to the next in close proximity.

SG-listed healthcare REITs are a bit........too peaceful? I admit that they are doing good, but my risk management system demands that I do not fall in love in them. Curve balls do come; it is not a matter of if but of when. Hence, they should not be granted exceptions in matters pertaining to position sizing.

I initiated a new position in Mapletree Commercial Trust when the price corrected in this quarter. It is a small position which I intend to build upon further during the next rights issue.

Finally, I added to gold and silver multiple times during this quarter. I wasted money on a graded gold coin I have been eyeing for a long time (there goes a chunk of my bonus.......) and a 2nd hand antique silver bar that was up for sale a couple of days ago.

Portfolio Overview and Capital Allocation thoughts

Both my SGD-denominated and my USD-denominated are in the green with small pockets of red from counters like Singtel, Thai Beverage, and QAF which has gone to the gutters.

My equity allocation still consists predominantly of REITs, reflecting my preference for an income-oriented strategy. It is complemented with property developers, consumer staples and healthcare stocks and a catch-all "others" category. The following lists are not arranged in position size.

REITs/Business Trusts:

AIMSAMP REIT, Frasers Centrepoint Trust, First REIT, Lippo Malls, Accordia Golf Trust, Parkway Life REIT, SPH REIT, Mapletree Industrial Trust, Mapletree Commercial Trust, Capitaland Mall Trust, Frasers Commercial Trust, Welltower REIT

Property Developers:

Hongkong Land, Frasers Property

Consumer Staples:

Dairy Farm, Sheng Siong, Thai Beverage, Yeo Hiap Seng, QAF, Kimberly Clark, JM Smucker, Hormel Foods, General Mills

Healthcare:

Raffles Medical Group, Abbott Laboratories, ISEC

Others:

Japan Foods Holding, ST Engineering, SGX, Singtel, SATS

I have the intention of transforming my equity allocation into a 5-sector portfolio consisting of REITs, consumer staples, healthcare, utilities, and a catch-all others category. As the US consumer staples and utilities sector rebounded lately, I've totally missed out on the action. If you are wondering, the valuation was just merely "fair"; it was not a screaming buy or anything like that.

I foresee the names in the above lists to shrink even further. Some of them have been found wanting for having a poor record.

There are some questionable names in the above lists as well. As I've managed to catch them at their lows, collect multiple rounds of dividends, and take partial profits when they went up, I am quite comfortable holding on to them still, even though their fundamentals are.......questionable. In the event of a rights issue for these questionable cases, I've already planned to either sell off the rights or to subscribe to my allotted rights. For such cases, excess rights are not for me!

In the interim, I am prospecting stocks. From a financials perspective, my Singapore and US watch list has, more or less, been firmed up. The next step is to dig deeper into their annual reports and familiarize myself with their business prospects.

Net worth breakdown

Compared to the previous quarter, there has been some changes to my net worth breakdown. Equity allocation decreased from ~39% to ~34% while cash increased from ~36% to ~40%. Precious metals increased slightly from ~24% to ~25%.

As per before, "the pie chart depicts the breakdown in my net worth across the various asset classes in percentage (pie chart neither includes my CPF nor my emergency fund). To be conservative, I computed my precious metals allocation at spot price even though I am holding everything in physicals."

CAPEX

After falling sick quite often and experiencing some form of burnt-out, I dropped out of my 3rd specialist diploma halfway (as detailed in my Q1 2018 post). Since then, I have been enjoying my free time first by casual reading, followed by prospecting stocks, and then by gaming.

Now that I am much more refreshed, it is time to engage in some personal CAPEX again. I have identified University of London's Graduate Diploma in Data Science (by distance learning) as my next education target and will be applying for it soon. The fees are quite economical (SGD $3800 for the entire programme) and the programme is rigorous, so that's good.

I signed up as a NTUC member last year in order to make use of the Union Training Assistance Programme (UTAP). Members enjoy course fee support for up to $250 each year when you sign up for courses supported under UTAP. Well, half of 2018 has gone by and I've yet to make use of UTAP. I've identified a few courses and will be applying and going for them shortly.

There will be some law certification programme that will be held at my workplace. I know it has no link with my current job scope but I went ahead anyway asking my bosses for their blessings. I wanted to acquire practical skills that could help me to be a better investor, but it was not meant to be in this calendar year. After all, they will be sending me to a tech course before the close of this calendar year.

Health

The above is not possible without sustained good health. The results from my annual health checkup concluded that my health is okay, with needed improvements in my total cholesterol levels and LDL cholesterol ("bad cholesterol") levels. I realized that I have been consuming more meat in my diet to cope with stress. I will be more conscious of my reaction to stressors from now on and to incorporate more exercise to my life.

Emergency Fund