Without realizing it, the last time I did a portfolio update was 9 months ago. The initial plan was to do up a year end post to make up for the dearth of portfolio updates, but my philosophical reflections got the better of me and I got lazy after that.

Moving forward, my quarterly updates will take a different format. Instead of going into the specifics, I will touch on broad generalities concerning each subsector in my portfolio.

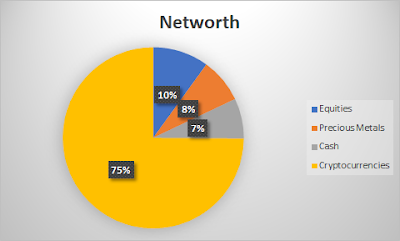

Cryptocurrencies as a percentage of networth has blossomed since the last portfolio update. This is attributed to capital gains, interest income, and remuneration from my 2 crypto part-time jobs. Of which, interest income contributed the most to the gains (surprise surprise! It is not capital gains).

Recently, I was offered another crypto part-time job. Unfortunately, I had to turn it down because I do not have the necessary skillset for it (grrrr! one day I shall learn this skillset!).

Let's move to the portfolio update. Do note that I'm a Crypto Native, so the strategies I employ is vastly different from non-Crypto Natives and my thought process may sound extremely foreign.

Layer 1s

I hold large positions in Layer 1s. To manage platform-related risk, around 1/3 of my layer 1 positions are kept in cold storage while the rest is out earning yield across both CEXes and DEXes. The selection of multiple CEXes and DEXes is to diversify risk from any one platform. Each CEX and DEX comes with their own risk profiles as well.

I don't spend much time valuing Layer 1s because of the myriad of contentious opinions concerning them. If one really wants to go down this, in my opinion, fruitless path, it is best to ask yourself questions pertaining to the hash rate, transaction volume, cost of transactions, the various players involved, as well as the network effects of a given layer 1.

Layer 2s

If you are a crypto native, you know that transaction fees on layer 1s have been skyrocketing due to huge demand for blockspace. Layer 2s aim to solve the issue of transaction fees by bringing it down to near-zero. This comes with trade-offs, of course.

I have been playing around with a couple of layer 2s to get a feel for them. Various layer 2s have rewarded early adopters for doing so; I received some tokens for using them.

The qualms I have concerning Layer 2s are their tokenomics (token economics). From the layer 2s that I've used, their tokenomics don't seem well thought out enough.

Just a little bit of trivia, whenever someone says that "blockchain helps the poor by reducing transaction fees", it is a straight giveaway that their experience with crypto is theoretical/minimal and they do not know what they are talking about. Plenty of crypto natives from developing countries have been priced out because it cost too much to pay for transaction fees on layer 1s. Hence, the often-asked questions of "Will there be a layer 2 solution? What layer 2 solution will your team be adopting?"

CeFi Play

Crypto is difficult enough. The technical competency required. The exploits. The learning curve. The first point of contact that people have with crypto is with Centralized Finance (CeFi) and Centralized Exchanges (CEX). There is a lot more handholding. More assurance. And if things go wrong, there is some firm to litigate against.

I got this idea from reading GMGH's tweets. When the masses come, it is CeFi that provides them with a gentle onboarding process. Some of these individuals may then develop into full-blown crypto natives. But for the large majority of them, CeFi is their first and final stop. CeFi Plays revolve around profiting from the increased onboarding of the masses to CeFi. I have a lower-mid position size in CeFi plays.

DeFi

Decentralized Finance, or DeFi, is a large catch-all term that includes financial instruments from money market funds and derivatives to options, robo-advisors and crypto indices.

The things to look out for in the DeFi subsector is the earnings, the sustainability of the earnings (aka. moat), the tokenomics of a given protocol, and the effect of competitors on a given protocol.

Taken together, my entire DeFi exposure should be the largest in my portfolio. I maintain larger positions in DeFi projects that have proven themselves and extremely small positions in more speculative projects.

Middleware Solutions

The simplest analogy of middleware solutions is the selling of pickaxes in a goldrush. More technically, middleware gets a percentage of cashflow when real-world data is brought into the blockchain and when blockchain data is brought back out into the real-world.

Middleware solutions are targeted at enterprises. Hence, retail investors do not see the benefits they bring because they do not have to pay middleware solutions for the services they provide; it is the enterprise that has to pay for it. This would appear as operating expenses on a crypto project's income statement.

I have mid-size positions in middleware solutions.

Interoperability Solutions

Blockchains exist as individual silos. Interoperability solutions are required to get them to communicate with one another. They facilitate the flow of liquidity across blockchains and, simultaneously, capture some value of that flow.

They are blockchain-agnostic. Hence, their survivability is not tied to any particular layer 1.

I have mid-size positions in interoperabability solutions.

Gaming

Blockchain gaming is a heterogenous category. Each game has to be assessed on its own merits.

Questions to ponder on blockchain gaming include the business model of the game, the remuneration for the developers, the tokenomics of the game, the community, the accessibility of the game, the cost to play the game, the popularity of the game, and how fun the game is.

I have mid-size positions in blockchain gaming. This is the dark horse in my portfolio. It completely outperformed and crushed every single crypto asset that I have.

Art

Blockchain art should be treated the same way as traditional art: illiquid alternative investments. I have bought a couple of pieces for both my enjoyment as well as an investment. The latter does not seem to be working out well for me though. Through this experience, I think I have a better eye for what makes a good art investment.

Virtual Worlds

Virtual worlds can be classified into one of two categories: (1) predominantly social worlds, with gaming functions that may or may not be added to them in the future; or (2) worlds that serve as the backdrop of blockchain games. I have some exposure to the latter.

The investment thesis behind them are that they are nascent form of virtual REITs. With that said, renters must derive a return above and beyond what they pay virtual landlords to make it worthwhile for them. For some of these virtual worlds, there is not only rent income, but royalty income to look forward to as well.

Stablecoins

Stablecoins are coins that are pegged to a given fiat currency (mostly USD). The pegging mechanism differs across stablecoins, with each having its own risk profile. I have some exposure to stablecoins in my portfolio. They are spread out across various CEXes and DEXes to reduce platform-related risks.

I hope I have not missed out anything. That's all for now.

Thanks for reading!

Hi UN,

ReplyDeleteWould like to clarify some things with you directly, could I email you? Can't find your email anywhere - could you kindly provide.

Thanks

Kelvin

Hi Kelvin,

DeleteSure.

It's unintelligent.nerd@gmail.com

Hi UN,

ReplyDeleteIt has been a long time since you blog! More than half of the article I don't understand. I am the noob that just started and going to CeFi. lol. Very impressive time management skill with multiple jobs! Jia you!

Hi KPO,

DeleteGood to hear from you again.

As a tech person, you'll pick it up quite quickly one lah!

Thanks!

Cheers

UN